IOU Central, a Montreal based startup, is launching today. They have staked their claim as Canada’s first Peer to Peer lending company. We covered the funding announcement of Toronto based CommunityLend back in December.

IOU Central, a Montreal based startup, is launching today. They have staked their claim as Canada’s first Peer to Peer lending company. We covered the funding announcement of Toronto based CommunityLend back in December.

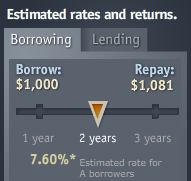

Peer-To-Peer lending has been maturing quickly as a concept on the heels of successful sites like Zopa and Prosper, but Canada has so far had no such providers. Peer to Peer lending is a concept that takes a large group of lenders who are willing to lend out smaller amounts of cash and connects them with borrowers who need access to cash at a rate that is below the standard credit card rates, but they are generally willing to pay a higher rate than if they had to go to a bank. A lender can be anyone with a bit of extra cash that they would like to get decent returns on.

From a borrower’s perspective, IOU Central operates much like any other lender, in that a borrower’s initial “rating” is based primarily on their credit score. You can however supplement that score by uploading a number of other documents to do things like prove your income, itemize your monthly expenditures and other things that can bump up your overall score.

From a borrower’s perspective, IOU Central operates much like any other lender, in that a borrower’s initial “rating” is based primarily on their credit score. You can however supplement that score by uploading a number of other documents to do things like prove your income, itemize your monthly expenditures and other things that can bump up your overall score.

IOU Central groups borrowers into 5 tiers: A, B, C, R, and HR. Borrowers in each tier pay IOU Central a service fee on top of the loan of 1%, 1.5%, 2%, 2.5%, and 3% respectively. Service fees varies because IOU Central expects to have to spend more to recruit lenders interested in higher risk borrowers and expect to face higher operating costs servicing loans to higher risk borrowers.

IOU Central charges Lenders a Lending Fee, which works out to about 0.5% annualized, calculated based on the amount of outstanding loans you have remaining each month.

The company was conceived over a year ago and their site has been in development for just under a year. There are currently 7 full time employees and they have raised a round of funding which includes Angels and VCs, but they did not disclose the amount of funding.

I asked Sam Bendavid, VP of Business Development for IOU Central, what sort of regulatory or legal issues they encountered running up to launch and he indicated that things were quite smooth. IOU Central is registered in Quebec as a lender and they worked closely with their law firm in developing their set of Legal Agreements.

IOU Central will be focusing most of their initial marketing on potential lenders. This is a smart move as lenders will be far more scarce than borrowers. Perhaps the days of getting a loan from Uncle Vinnie are over, and Canada now has a safe, regulated, and legal place to secure peer to peer loans.

Update: The Star provided some further coverage a few days later.

When Heri first announced

When Heri first announced  With this announcement and their launch at DEMO, StandoutJobs is taking back the veil on their business model. When we first saw them almost a year ago, StandoutJobs looked like a recruiting company that did videos, and we didn’t find it very compelling. I got to hear more a few months ago however over supper with

With this announcement and their launch at DEMO, StandoutJobs is taking back the veil on their business model. When we first saw them almost a year ago, StandoutJobs looked like a recruiting company that did videos, and we didn’t find it very compelling. I got to hear more a few months ago however over supper with

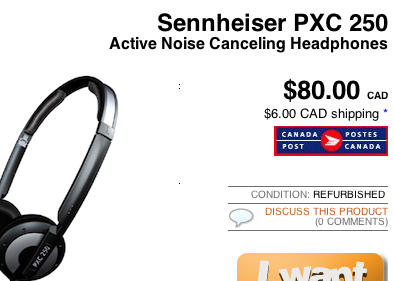

It turns out it’s not easy. The first deal to hit the front page of Razzle was for a pair of brand new Sennheiser RS110 headphones for around 50$. By all means, a great deal even with shipping costs factored in.

It turns out it’s not easy. The first deal to hit the front page of Razzle was for a pair of brand new Sennheiser RS110 headphones for around 50$. By all means, a great deal even with shipping costs factored in. Ok, this takes guts: entering a market with a niche product where the incumbent is not only a darling of the industry, but owns the primary platform on which you are going to have to compete for users.

Ok, this takes guts: entering a market with a niche product where the incumbent is not only a darling of the industry, but owns the primary platform on which you are going to have to compete for users.  If you believe, like I do, that user generated content is, and will be even more of, a big deal, then you have to accept that SPAM is going to be an even bigger problem down the road. Where Norton and McAfee made millions selling anti-spam products for your Outlook client, Defensio has an opportunity to become the enterprise-strength anti-spam solution for user-generated content.

If you believe, like I do, that user generated content is, and will be even more of, a big deal, then you have to accept that SPAM is going to be an even bigger problem down the road. Where Norton and McAfee made millions selling anti-spam products for your Outlook client, Defensio has an opportunity to become the enterprise-strength anti-spam solution for user-generated content.