This is part of a series on Extreme University and the first group of graduates from the Summer 2009 program.

A Toronto-based startup that first went live in May 2009, Assetize has been focused on helping people turn their accounts into assets. The premise is that, similar to domain names, online accounts like email addresses and Twitter accounts also have some fundamental value because of their usernames or audience reach. However, unlike domain names – which are sold and parked in a multi-billion dollar industry – these values haven’t been realized yet.

A Toronto-based startup that first went live in May 2009, Assetize has been focused on helping people turn their accounts into assets. The premise is that, similar to domain names, online accounts like email addresses and Twitter accounts also have some fundamental value because of their usernames or audience reach. However, unlike domain names – which are sold and parked in a multi-billion dollar industry – these values haven’t been realized yet.

I met Saif and the Assetize team recently when I visited the Extreme University program, where they are one of the startups in the incubation program by Extreme Venture Partners. Assetize is trying to be the AdSense for Twitter. Just as people are able to monetize their websites and blogs through AdSense, Assetize lets users include ads in their Twitter accounts effortlessly, and helps advertisers reach their target audiences. They have built a proprietary technology in-house that analyzes each account’s content to ensure that the ads being served are relevant to followers.

Quick Analysis

Management Team

The management team consists of Saif Ajani, Mike Rhemtulla and Minaz Abdulla. Separately, they have worked with numerous Fortune 500 companies as tech consultants, and have also launched 2 previous startups together. This is a young team that has shown that they can deliver in a short time period. Building a strong set of advisors and continued demonstration of traction will help them go a long way. As a side note, I’ve worked with Minaz in the past (at Ambient Vector), he is an incredibly talented engineer that has demonstrated his ability to produce and ship great code.

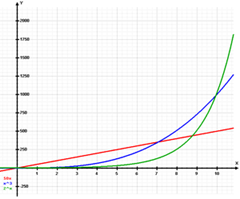

Market

According to the online marketing research firm, eMarketer, companies are expecded to spend upwards of $32B in online advertising by 2011, with almost $2.9B of it going towards social networks. Although MySpace and Facebook have been the most dominant networks thus far in terms of drawing ad dollars, Twitter is exploring advertising. As people spend more of their “media time” on social sites, agencies and brands are seeking new channels and opportunities to create connections and advertise to audiences. This is a growing space that is ripe for innovation and new opportunities.

Product

The goal of the product is to help users increase the value of their social media assets. For Twitter users this is a combination of relevant content, reach and connection. Users can use Assetize to find content to attract, retain and engage their connections. The process to setup the Assetize service for a Twitter account seems very simple and straightforward. Users have a one-step process to register their accounts and provide a list of topics that they tweet about. Assetize provides access to over 100,000 feeds that can be used to find and publish value-added content. The idea is that more and better content attracts a larger base of users and inject ads into the Twitter stream that have a higher response rate. Analytics is provided on links and conversations.

The company is currently working with advertisers to build out the functionality. The core of the Assetize product is an ad matching engine that analyzes previous posts and matches users to available/relevant ads. AdSense’s value comes from making its ads targeted to the content on web pages, and the Assetize engine aims for contextual, relevant Twitter ads for each author based on posts and conversations.

Business Model

Similar to other online ad networks, Assetize earns a commission basis, and share revenue with Twitter account owners. Since this commission is performance-driven, it’s a good incentive for Assetize and its members to optimize accounts so that advertisers receive good returns on their investments. The business model requires scale to have a large enough capacity of users and a large inventory of ads to continue to ensure relevancy to each party.

Strategic Relationships

Assetize is a young company. They are starting to build relationships with advertising agencies to help bring their clients to Twitter. As use of social media continues to grow, particularly among the lucrative 18-24 audience, no doubt many brands will look for easy, familiar steps to test advertising on Twitter. The team is eager to explore these relationships, if you are an advertising/marketing/social media agency looking to explore a relationship, they are actively looking at how to partner and work together.

Competition

Izea, the company behind PayPerPost for blogs that has a raised a total of $10M in VC funding, recently launched SponsoredTweets, a service that pays Twitter users to write short posts about its clients’ products. It requires more effort from Twitter users than Assetize’s service. The Twitter advertising ecosystem is continuing to develop and evolve, there is most likely room for a variety of models and engagement strategies.

Other competitors include Be-a-Magpie, a service based out of Germany and Great Britain, and RevTwt. The coverage they received earlier in the year undoubtedly led to a good user base, but their list of advertisers seems to be lacking. If Assetize is able to overcome these two startups, they’ll need to gain better access to advertisers than its competitors were able to.

There is always existing social media ad networks. Each of these companies has relationships and inventory, though they are not easily translatable into an effective 140 character campaign.

Summary

It’s a very interesting product. There is an opportunity around defining effectiveness of advertising for social media sites, but early the familiarity of CPM and CPC that is brought Assetize may help drive early adoption with agencies and brands. There are challenges in securing a large audience, a large inventory and strong relationships with agencies. Assetize has an interesting value proposition for users looking to monetize their Twitter “assets”. Great start for an ExtremeU company!

Sure we know Steve from the Apple I and Apple II computers. You might even know him from Dancing with the Stars. You probably didn’t know that the Gipper awarded him the National Medal of Technology, the highest honor bestowed America’s leading innovators, in 1986. And Steve Wozniak is still working on new technology. He’s a the chief scientist at Fusion-io working flash-based memory architectures for storage. He’s on a member of the board for member of the board of directors for Jacent, a developer of cost-effective telephony solutions, Danger, Inc., developer of an end-to-end wireless Internet platform, Ripcord Networks and others.

Sure we know Steve from the Apple I and Apple II computers. You might even know him from Dancing with the Stars. You probably didn’t know that the Gipper awarded him the National Medal of Technology, the highest honor bestowed America’s leading innovators, in 1986. And Steve Wozniak is still working on new technology. He’s a the chief scientist at Fusion-io working flash-based memory architectures for storage. He’s on a member of the board for member of the board of directors for Jacent, a developer of cost-effective telephony solutions, Danger, Inc., developer of an end-to-end wireless Internet platform, Ripcord Networks and others.