[Editor’s Note: This is a guest post by Gideon Hayden LinkedIn , associate at OMERS Ventures and previously founder of Tradyo. Full disclosure: I work with Gideon at OMERS Venture and I have tracked his progress at Tradyo with his partner Eran Henig over the past few years.]

“You know, one of the things that really hurt Apple was after I left John Sculley got a very serious disease. It’s the disease of thinking that a really great idea is 90% of the work. And if you just tell all these other people “here’s this great idea,” then of course they can go off and make it happen.

And the problem with that is that there’s just a tremendous amount of craftsmanship in between a great idea and a great product. And as you evolve that great idea, it changes and grows. It never comes out like it starts because you learn a lot more as you get into the subtleties of it. And you also find there are tremendous tradeoffs that you have to make. There are just certain things you can’t make electrons do. There are certain things you can’t make plastic do. Or glass do. Or factories do. Or robots do….

And it’s that process that is the magic.” – Steve Jobs quote as quoted by Travis Jeffery of 37 Signals

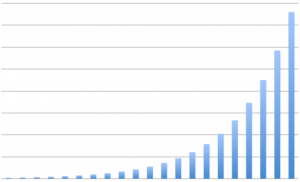

The lifecycle of consumer hardware startups is undergoing a rapid transformation (see Chris Dixon’s Hardware Startups). Consider the well known Pebble Smartwatch; the first example of a company that perhaps unintentionally used crowdfunding to demonstrate demand for their concept long before they had the ability to produce it at scale. The $10.7M raised significantly decreased the upfront risk for the company, allowed them to avoid dilution by avoiding traditional financing methods, and decreased their inventory risk due to this ability to accurately forecast demand before production.

This change in the stage of demand generation represents a new paradigm for hardware startups. Whereas before they likely had to build and scale manufacturing prior to generating demand for their product, they can now accurately forecast this simply by gauging reactions to a proof of concept video.

However, the purpose of this post is not to highlight all the good stuff surrounding this method of funding for hardware startups; I think those are largely well known and accepted. Instead, I’d like to address what other impacts this change has on the lifecycle and trajectory of a company.

Exploring the Impacts

Firstly, with large surges of excitement and accompanying pre-orders surrounding these campaigns, a company has to jump from a conceptual and iterative stage to become an operational company thereby skipping a lot of crucial steps in between. Perhaps one of the most important steps they must skip is the pricing strategy for each unit. Without sufficient vision into QA, returns, defective products and COGS, they can’t accurately work these costs into the price of the product. Furthermore, if we look solely at the numbers, the outlook for the company is bleak as they’ve already locked into a certain price with their pre-orders, as well as a specific timeline, and this can end up costing the company huge amounts of money down the road.

See below to visualize this change:

Old World:

Team → Concept → Seed → Prototype → Financing → Design/Manufacture/QA → Iteration → Pricing of product → Pre orders → Distribute

New World:

Team → Concept → Seed → Prototype → Pricing of product /Timeline commitment → Video launch → Pre orders → Financing (maybe) → Design/manufacture/QA → Distribute → Iteration

In the new world, companies price their product very early on, and jump from video launch to production. This places them on a trajectory that perhaps they aren’t ready for.

Let’s consider other impacts of this change:

- Risk is transferred from the company to the consumer

- In the old world, consumers saw a pre-order to launch time of 2-3 weeks. In this model it changes to around 9 months to 1 year.

- The increase in time from demand generation to product in market is far longer in the new world. No Kickstarter hardware campaign has brought their product to market in less than 9 months from the close of their pre-orders – meaning consumers have to wait far longer than they’re use to for the product.

- The 9 months to 1 year is long in terms of time from pre-order to time of distribution, but actually very short when we put this in the context of the stage of the company and the typical time between conception of a product to larger scale distribution.

- Effectively what this means is the risk is transferred from the company to the consumer. In the old world, companies would have to take shots in the dark and validate their concept after an upfront investment in manufacturing. Today even if the product is a flop consumers will have to pay.

- Less appetite from consumers for second chances

- Whereas in the past consumers may have given hardware products second chances (see Jawbone UP V1 vs. V2), by the time these products are in the consumers hands there may be less interest and far less enthusiasm to give the product a second chance.

- The amount of time from showing intent to gratifying their demand is so long in this case, that they may have even written it off even by the time they receive it. All this means is you better strike some resonance with the consumer on this first push.

- Feedback Cycle Lengthened

- The cycle between launch and iterations to the product is far harder to manage in this model. By the time you’ve scaled operations feedback is just beginning to roll in – and you may lack the resources to implement the needed changes to the product.

- Perhaps the more important feedback cycle in the new world has become the software iteration cycle that sits on top of the hardware. Often this takes a backseat as scaling manufacturing is a massive task unto itself, but in today’s world, this is where the real value stems from.

- Shipping incomplete products

- As mentioned, much of the value stems from the SDK attached to the hardware and providing the infrastructure to allow developers to build applications on top of the platform.

- With an underestimation of the time required to scale manufacturing, SDK’s often take a back seat and the products ship with limited functionality – far more limited than demonstrated in the concept videos.

- Furthermore by accelerating the demand, companies often miss out on the experimentation/iterative phase of prototype development. They commit to a timeline and have to choose a solution before they may be ready.

- With the demand to scale operations so quickly, the QA process inevitably takes a hit as well and can result in higher costs down the road.

- Discovery and experimentation phase cut

- In the new world, the video launch occurs before scaling of production happens. This process can teach a company a tremendous amount, but because they have often committed to a timeline and promised a certain product, they’ve locked themselves into something that is great conceptually, but may not be feasible in reality.

- This discovery and experimentation phase is shortened greatly, and as Steve Jobs mentioned, this is the process that is magic.

- Inaccurate Timelines

- 84% of kickstarter/pre-order projects will miss their deadlines.

- Threat From Incumbents to Pick Off Technology

- Proven demand with an inability to act allows bigger competitors to jump in and launch competitive products really quickly – seeing this now with Apple/Sony and Pebble

One of the classic problems that lead to startup’s demise that we hear of all the time is pre-scaling. Companies start building out the core features of their business without truly knowing what they are. As they increase their burn rate to high levels, their margin for error becomes extremely low by the time they reach market. If that initial product doesn’t hit a nice trajectory, they’d better find it fast because the cash in the bank will only last them so long before they have to raise again, and if they haven’t proven anything by that time, it likely won’t be an attractive prospect for investors resulting in a down round, or worse.

This is not to say that this new process is a negative shock to the ecosystem, quite the opposite actually. I think crowdfunding and proof of concept similar to that of concept cars spurs innovation and creativity, and encourages new entrants to shoot for the stars; something we always need more of.

However, the risks of the new world have not yet been explored in depth, nor have they actualized as many of the relevant companies are still very young. Many processes like QA and iterative industrial design inevitably decrease in quality and leads to lower quality products shipped, higher cost of returns, and inaccurate pricing of the product; a dangerous game to play.

Crowdfunding and pre-orders is definitely a good thing, but perhaps we need to recognize where along the lifecycle of a company this process exists, and what exactly it proves. It does not mean the company is successful, but merely represents one proof point out of many needed along the journey to building a great company.

![]()

![]() Some rights reserved by Dan T Townsend

Some rights reserved by Dan T Townsend