Global software vendors are starting to feel the disruptive effects of the software as a service business model (“SaaS”). The SaaS model is growing at an annual rate of 15%-20% and will likely represent approximately 25% of the overall software market in the next 5 years. Although this trend is starting to call into question the viability of the traditional software business model, we are quickly reminded that today 95% of software businesses still earn most of their revenues and profits from traditional perpetual licenses and maintenance revenue streams that continue to experience year-over-year single digit growth.

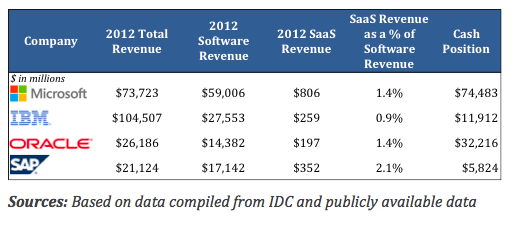

For the large global vendors, it is difficult to transition from a traditional license to a subscription-based model. If you look at the largest 10 global enterprise software companies including Microsoft, IBM, Oracle, and SAP, less than 2% of their revenues are derived from SaaS.

Global Software Companies With Large Cash Positions Will Be Looking to Increase SaaS Penetration

Here are some of the reasons we believe the transition has been so difficult:

- It is hard to move away from the significant upfront fees earned through perpetual licenses to a much smaller recurring monthly fee. This would decrease immediate earnings and negatively affect the valuations of the large public vendors.

- The SaaS business model has not yet proven itself in any meaningful way to be viable given the limited number of software businesses that have achieved scale and profitability.

- Most in-house development and implementation teams are not structured to build and deliver multi-tenant solutions through the web. This requires significant investment and time.

- Traditional sales teams have not educated their customers to accept monthly recurring fees and are not structured to facilitate a low touch sales approach.

- IT departments have been reluctant to share sensitive data through the web for security reasons.

However, the SaaS business model has some clear advantages that are compelling to its customers:

- There are no significant upfront fees.

- The client always has the most up-to-date version of the software.

- The software is easily configurable and takes less time to implement than on-premises solutions.

- Security has been less of a concern with the introduction of secure data sites and private clouds. Software is being audited to ensure it meets compliance guidelines.

- Employee workflow is much more efficient, the software is mobile friendly and can be accessed from anywhere.

There is no question that the SaaS delivery model is more efficient and compelling than an on-premises solution. Having said that, businesses have invested significant time and money in legacy software and in the foreseeable future these businesses will be reluctant to make a change.

As businesses gradually adapt to the SaaS model, it is taking a while for SaaS companies to reach meaningful scale. Selling licenses at thousands of dollars a month (and in some cases hundreds of dollars a month) and educating customers along the way is a difficult path. We estimate that there are only 50-100 private companies in Canada that have reached critical mass in excess of $5 million a year in recurring revenues.

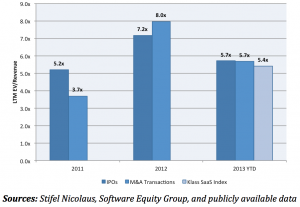

We believe that the limited number of SaaS businesses of meaningful scale has created scarcity in the market, driving up valuations. The ten largest global enterprise software companies have in excess of $200 billion in cash and are looking for ways to increase their exposure to the SaaS market. In June 2013 there were two significant acquisitions: SAP acquired Hybris for $1.3 billion and Salesforce.com acquired ExactTarget for $2.6 billion (8.1x LTM revenues). In 2013, seven companies went public and are currently valued in excess of 6x revenues. Additionally, the group of public SaaS businesses that we track currently trades in a range of 5.0-6.0x 2013 sales.

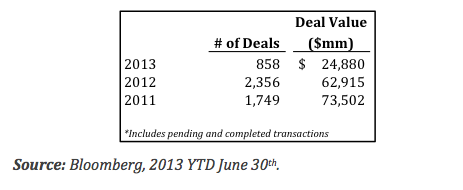

Software Companies Have Looked to Grow Through M&A And Will Continue To Do So

Although venture capital and private equity’s interest in the enterprise software space is at a historic high, the dollars invested in Q1 2013 is at one of the lowest points in the past 5 years. We believe that three factors are likely driving this decrease in activity:

- There are a limited number of SaaS businesses that have reached scale and are supported by experienced management teams.

- Most of the venture dollars have been sitting on the sidelines and have been raised by fewer funds that are not readily accessible.

- Valuation expectations of entrepreneurs are not in line with those of investors.

Enterprise SaaS Valuations Remain High

We are confident that the SaaS business model will continue to gain acceptance throughout the market and that we will see emerging Canadian SaaS businesses gain critical mass. In turn, these businesses will be well funded by both Canadian and US venture capitalists. In addition, there have been over twenty $1 billion strategic SaaS acquisitions since 2011 and we expect this pace to continue or accelerate as the larger enterprise software players seek to participate in this major market transition.