Editor’s Note: This is cross posted from WhoYouCallingAJesse.com by Jesse Rodgers, who is a cofounder of TribeHR. He has been a key member of the Waterloo startup community hosting StartupCampWaterloo and other events to bring together and engage local entrepreneurs. Follow him on Twitter @jrodgers or WhoYouCallingAJesse.com.

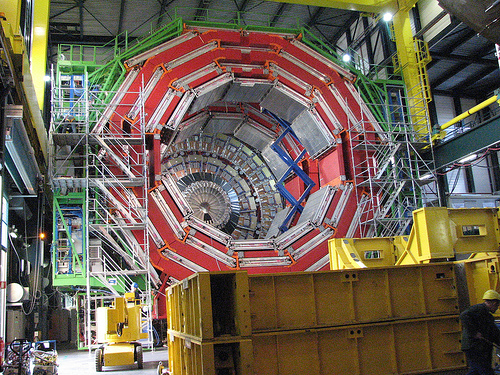

![]() Some rights reserved by Nathan E Photography

Some rights reserved by Nathan E Photography

Incubators and accelerators are businesses just like the businesses they intend to help develop as they travel through the startup lifecycle. As with any business, there are indicators that they can measure to give them a better idea of how they are performing besides the big public relations buzz around a company being funded.

You need to measure these numbers so that when a success happens you can hopefully gain some insights on how to help the other companies better. The problem is that even though the model of an incubator or accelerator is generally known, how to take 10 companies and have 10 successful growth companies come out the other side of the program is not.

The issue of what metrics to use is an important but complicated problem to solve.

Set the baseline at the application process (pre-program)

There are far more applicants than slots offered in an incubator or accelerator program. However, it is at this point that a program is gathering it’s best intelligence. You need a baseline measurement at the start of the program that you can measure every team against. What you should be tracking:

- Who applied to the program that you didn’taccept (this is your control sample)

- Track their progress on Angellist, Crunchbase, and/or go back to their web site in 3, 6, 12 months.

- Keep a ratio of who is still in business and what their status is.

- Maintain, in a CRM system, information on the applicant founders and their team members.

Measure the incubator/accelerator clients (in-program)

At this point there are X number of startups with Y number of founders and maybe Z employees. What you want to measure are things that demonstrate they have improved (or not) and which are things you would expect to see improve as a result of the services provided by any incubator or accelerator:

- Current customers and revenue per customer (for most that will be 0 at the start) that will work across revenue models: CAC, ARPU, churn rate.

- Sales funnel – do they have leads? How many? Are they qualified leads? What are they worth?

- Average user growth in the last month.

- What mentors or advisors did they meet through the program? What role did they take with the company?

Run these numbers at the start and at the end of the program. If you are a pure research focused incubator, ignore this section. You have a much longer time to see success – but few are truly research focused.

Monitor the graduates: Alumni (post-program)

This is a very important thing an incubator/accelerator can do — build and maintain its alumni connections. These folks not only help at every stage of running future programs but their success lifts the profile of the program, just like how alumni of prestigious business schools make the business schools prestigious.

There should be reporting milestones at a set interval (probably financial quarter based) where you gain the following insights on the company:

- Customer growth percentage: CAC, ARPU, and churn rate all expressed as percentage growth.

- Sales funnel growth expressed as a percentage.

- Average user growth in the last month.

- What mentors or advisors are currently active with the company?

Ideally you should have a position that is equivalent to a close advisor or board observer with the company once it graduates from the program.

Defining success

If an incubator or accelerator program is successful, the graphs should be heading up and to the right at a much faster pace than they would have been had startups not entered the program.

The only baseline data I know of is from the Startup Genome. In their report they explain the stages and the average length of time it takes a company to go through them. For an incubator or accelerator to demonstrate that they work, I would expect a successful company to move through the stages faster than the average. I would also expect them to fail faster than the average.

Tracking metrics puts a lot more overhead on an accelerator. It is likely more than they budgeted for to start. However, if you want to know if the program is successful it is worth the investment of an admin salary to track and crunch data. This is just a baseline, track more and figure out what the indicators of success are for you.