We have a bit of a thesis here at StartupNorth, and part of that thesis is that the biggest problem with the startup environment here in Canada isn’t that VC’s aren’t investing as much as we might like these days, or that American VCs are scooping up all the good deals (sure, those are all problems too), but we think that the biggest issue is that there is no push that gets an early stage idea from the notepad to the web.

We have a bit of a thesis here at StartupNorth, and part of that thesis is that the biggest problem with the startup environment here in Canada isn’t that VC’s aren’t investing as much as we might like these days, or that American VCs are scooping up all the good deals (sure, those are all problems too), but we think that the biggest issue is that there is no push that gets an early stage idea from the notepad to the web.

18-30 year olds just aren’t starting and following through (to failure even) with those great ideas. This in turn kills the number of startups created later on once that group grows up, and with no mass of startups to move things forward, we end up with many of the problems we have today.

This has nothing to do with not having a Silicon Valley equivalent, and there is no simple solution like “start a Y-Combinator Canada”, instead we are going to need to do a lot of trial-and-error experiments before we start to get an idea of how to really get to the heart of the issue. So, any time I see someone stepping up to try their hand at it, I get excited.

This coming fall The University of Waterloo will be The Minota Hagey residence in to a “Mobile + Media” incubator that will house 70 UW students who are “UW?s most ambitious, entrepreneurial and tech-savvy” and “will not only live together, but they?ll also work in teams to develop ideas with commercial potential, either as part of their regular coursework or as an extra-curricular initiative.”

The common areas of the residence will be renovated over the summer to create a large common/presentation space, a boardroom/meeting room and a project room/mobile device lab. The residence will receive technological upgrades to support the work of the students and to enhance the living environment (ie wifi, increased bandwidth, large project screen, audioconferencing, plasma/LCD screens, workstations, high-end programmable lighting…foosball!)

The common areas of the residence will be renovated over the summer to create a large common/presentation space, a boardroom/meeting room and a project room/mobile device lab. The residence will receive technological upgrades to support the work of the students and to enhance the living environment (ie wifi, increased bandwidth, large project screen, audioconferencing, plasma/LCD screens, workstations, high-end programmable lighting…foosball!)

While I am pretty sure that Plasma TVs and programmable lighting (prime prank-hacking territory!) aren’t exactly critical to getting startups off the ground, this is all starting to sound pretty cool. It is definitely new and cutting edge for Canada.

So, the idea is to pile 70 keen and smart students in a dorm and to see what sort of partnerships and startups might spring up. Sounds awesome so far. VeloCity is a great concept, and I can’t wait to start hearing about some of the startups that come out of it.

For every bit of excitement, I do feel an equal amount of trepidation. This is the kind of thing that is easy to get wrong. All you need is for the culture of the place to go off the rails just a little bit and all of a sudden you just have an expensive dorm with a fancy coat of paint. While I am sure that there are a slate of mentors lined up and a full calendar of events, you need people there almost every day to influence the direction of the students.

This pretty much makes Waterloo the go-to university for students serious about doing a startup (excepting those who just don’t go do university at all). In an ideal world this would available to everyone, but it is only for Waterloo students. If you are a Waterloo student, you can apply here.

Someone call PizzaPizza and negotiate a special deal, it’s going to be a big year for late night delivery at Minota Hagey.

PlateSpin, based in Toronto, has entered into a definitive agreement to be acquired by Novell for $205M. The company, which makes a suite of solutions for the server virtualization market, was founded (for the second time) in 2003. You see, PlateSpin is a restart.

PlateSpin, based in Toronto, has entered into a definitive agreement to be acquired by Novell for $205M. The company, which makes a suite of solutions for the server virtualization market, was founded (for the second time) in 2003. You see, PlateSpin is a restart.

A lot of startups seem to be building their web apps in Ruby On Rails and have been for a while, so I thought it was worth mentioning that Toronto is home to the least-boring Rails conference so far.

A lot of startups seem to be building their web apps in Ruby On Rails and have been for a while, so I thought it was worth mentioning that Toronto is home to the least-boring Rails conference so far.

Just a reminder that next week on Tuesday February the 26th is

Just a reminder that next week on Tuesday February the 26th is  Montreal seems to be the hotbed for controversy in the Web 2.0 world in Canada. Where else could you find someone who

Montreal seems to be the hotbed for controversy in the Web 2.0 world in Canada. Where else could you find someone who  La Presse, a French-Daily in Montreal has been

La Presse, a French-Daily in Montreal has been  IOU Central

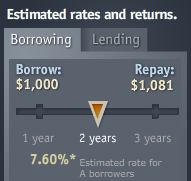

IOU Central From a borrower’s perspective, IOU Central operates much like any other lender, in that a borrower’s initial “rating” is based primarily on their credit score. You can however supplement that score by uploading a number of other documents to do things like prove your income, itemize your monthly expenditures and other things that can bump up your overall score.

From a borrower’s perspective, IOU Central operates much like any other lender, in that a borrower’s initial “rating” is based primarily on their credit score. You can however supplement that score by uploading a number of other documents to do things like prove your income, itemize your monthly expenditures and other things that can bump up your overall score. Tomorrow morning at 9am (Friday, February 8th 2008) there will be a meeting at Foreign Affairs and International Trade Canada?s Toronto offices (151 Young St, 3rd floor boardroom) to discuss their subsidy for any companies who are going to be going to

Tomorrow morning at 9am (Friday, February 8th 2008) there will be a meeting at Foreign Affairs and International Trade Canada?s Toronto offices (151 Young St, 3rd floor boardroom) to discuss their subsidy for any companies who are going to be going to