Just a reminder that you have until Sunday, October 12th to purchase tickets at the early bird price. You can get your tickets here.

Just a reminder that you have until Sunday, October 12th to purchase tickets at the early bird price. You can get your tickets here.

I guess I can’t stay out of the conversation on this any longer.

I guess I can’t stay out of the conversation on this any longer.

I am no expert in downturns, recessions or being poor. But I have a feeling a lot of us are going to learn about at least two, and possibly all three of those things. We are in for a bit of a rough ride, and contrary to what you might be hearing, we might be in for a longer and more difficult few years as startups here in Canada.

Things haven’t be rosy lately, we have written a lot about that, but it has had very little to do with the current situation. Capital for startups in Canada has been tight for years, and the slow deaths of many of our Venture Capitalists have been because of poor performance (among other things) rather than tightening credit. Now, we have both.

We have Venture Capitalists who were having enough trouble raising funds and who will now have almost no hope of raising capital. This is not good for anyone.

So, what can you do? How can we work around this? What will the next few years look like? I don’t know for sure, but I can tell you what I am doing:

Get your personal finances in order. $200 cable TV bill? Get rid of it. $70 gym membership? Gone. Constant and expensive use of your cellphone? Goodbye. It is going to be different for everyone, but you need to build up a small nest egg if at all possible. I’m not telling you to stock up on canned beans, but if there was a time to learn how to manage your personal finances, this is it.

That bread and butter contract you do on the side to pay the bills? It could be gone tomorrow. You need to know what you are spending and why, and you need to know where you can cut when things get tight.

Know your cash flows! Ever since you did a cash flow statement when you started your company, you may not have gone back and reworked your projections, instead you have probably just let you accountant keep them up to date, but have not looked at things too closely. You know your hiring schedule, and you know how high your expenses can be ever month, but you now need to make sure your projections a year out are still solid.

How vulnerable is your revenue stream? Which cost-centers can you get rid of quickly and efficiently if you have to bring your burn rate down? You need to know when to pull the trigger, and where to shoot. When the time comes: Just do it.

Just raising financing? Get to revenues fast, within 6 months, there is less time now to prove out a model over the long term, it is important to compress your cycles a bit for a few reasons. You need to be able to test and learn more, with less.

Are there better target markets? Those of us in the Enterprise space are going to be in for a bit rougher of a ride, but we also have an advantage. If we are building a product that saves the customer money, and are selling to them based on ROI, then there is even an opportunity here. If your software creates efficiency, reduces complexity or streamlines and existing product, then you have something to sell.

If on the other hand, your product is focused on less tangible benefits, then you are in for a slow period. This is going to effect a lot of Enterprise 2.0 startups who haven’t narrowed down their product offering yet.

On the consumer side, things probably aren’t a lot different. If you are trying to change behavior, this is going to be a terrible time to try to do it. If however, you are making someone’s life easier or more enjoyable, then they will be able to see the value and you have an opportunity.

These rules all apply any time, and even more so now.

Don’t head for the hills. This is a time when a lot of people are going to have to go get jobs. Some of us will have to, there just won’t be any choice, but it is not the time to do it if you can help it.

You are going to create some of your most incredible products and companies during down times. Hunger and frugality (the traits of great entrepreneurs) are rewarded in times like this. Flashiness and and excess will no longer be looked at in the same way they might have been in the last few years. This will be true here in Canada and everywhere.

The need for revenue will force you to pick up the phone that much sooner, or to get your product to market that much more quickly.

This might just be our time. Canadian Startups, who have been hungry for years now, have a chance to shine. We have been building companies that people called un-ambitious. We were told that we did not think big enough and that we were too risk averse. That may have all been true (and I think it was, when people were saying it in the last few years), but we now need to swing this to our advantage.

Lets lead the way and teach the world how to grow great companies in the middle of an economic drought. You’ve built a capital efficient business, you have a strong customer base and a product people want.

Don’t slow down now, this is just the time to make a break for it.

Headsup! Startup and Community North’s sister site (better half?) WirelessNorth.ca is sponsoring a mobile developers meetup in Toronto this Thursday (that’s October 9th, 2008) at the Bedford Academy on leafy Prince Arthur street. There will be beer, fellow developers, tasty nachos and some prizes to give away. This meetup is focused on iPhone developers in celebration of the lifting of your NDA, but all mobile devs and startups with a mobile angle are welcome. Hope to see you there.

Deets: Toronto Mobile Developers Meetup Thursday on WirelessNorth.ca

echoage is a new Toronto, On based startup that is trying to change how we think about throwing the age old birthday party.

A friend of mine was complaining the other day that people were bringing 150$ gifts to her son’s birthday. “What is with private school parent’s?” she wondered.

I have no idea what is causing people to buy 150$ gifts for 5 year olds, but if that kind of money is being spent, there is a business to be made.

Using EchoAge you send out an invitation via email to the friends of your child. When the recieve the invitation, they are asked to, instead of bringing a gift to the party, donate some amount of money to a single charity. EchoAge takes the payment online and confirms everything. The total amount of donations are then pooled and it is split up to buy one gift for the child and then the rest is sent to charity, with EchoAge taking a cut in there somewhere.

Here?s how: Guests are invited to an ECHOage birthday party online. Instead of bringing a wrapped and packaged present, guests simply RSVP and give a secure online gift of money. Payments are pooled for the purchase of ONE special gift for the birthday child and to support ONE meaningful cause. The site provides online invitations, thank you notes, awards, allergy alerts and even keeps track of RSVPs and the money your child has raised.

ECHOage arranges everything, so there is no need for guests to drive, shop, wrap or even pick up the phone to make a donation.

With a recent mention in Vanity Fair co-founders Debbie Zinman and Alison Smith off to a great start.

Earlier today Toronto based fOTOGLIF, an emerging ad?supported stock photo portal, announced partnerships with Getty Images, Thomson Reuters, and Splash News. These partnerships should help deliver stock photo content, thereby solving one piece of the puzzle: inventory.

Earlier today Toronto based fOTOGLIF, an emerging ad?supported stock photo portal, announced partnerships with Getty Images, Thomson Reuters, and Splash News. These partnerships should help deliver stock photo content, thereby solving one piece of the puzzle: inventory.

fOTOGLIF’s business model is to provide free ad-supported stock photos. I embedded an example below. Would you use ad supported stock photos on your blog? How about if I told you Idee was monitoring unauthorized use?

Things have been coming together quickly for StartupEmpire. I am excited to announce some incredible new speakers, and we will keep announcing others as they are confirmed.

Things have been coming together quickly for StartupEmpire. I am excited to announce some incredible new speakers, and we will keep announcing others as they are confirmed.

The interest so far has been pretty amazing. There have been so many speaker submissions that we have had to completely revisit the agenda for both days of the conference. You still have a chance to submit your proposal in the next few days, and we will still take a look for anything that we think we need to get on the program.

We have just confirmed that Don Dodge, Hugh MacLeod and David Cohen will be joinging us as keynote speakers.

Don Dodge is currently the Director of Business Development for Microsoft’s Emerging Business Team and was recently a panelist at the TechCrunch50 conference. Don calls Microsoft ?the biggest start-up in the world? and his job is to work with VC’s and start-ups to help them build great companies.

Don Dodge is currently the Director of Business Development for Microsoft’s Emerging Business Team and was recently a panelist at the TechCrunch50 conference. Don calls Microsoft ?the biggest start-up in the world? and his job is to work with VC’s and start-ups to help them build great companies.

Hugh MacLeod has been an inspiration to many of us. His work with English Cut and Stormhoek were some of the earliest successes in using blogs to communicate a message cheaply and efficiently, which are much needed lessons for new and old startups alike.

Hugh MacLeod has been an inspiration to many of us. His work with English Cut and Stormhoek were some of the earliest successes in using blogs to communicate a message cheaply and efficiently, which are much needed lessons for new and old startups alike.

David Cohen is the founder and CEO of TechStars in Boulder Colorado. TechStars has been one of the most successful seed stage funds in the world. David is also the founder of ColoradoStartups.com, a blog focused on tracking Colorado Startups.

David Cohen is the founder and CEO of TechStars in Boulder Colorado. TechStars has been one of the most successful seed stage funds in the world. David is also the founder of ColoradoStartups.com, a blog focused on tracking Colorado Startups.

Don’t forget to get your ticket before the early bird deadline, or ASAP before we sell out. The venue is small enough that we really can’t add more.

Thanks for all your support, we are working hard to create something that is valuable and that you will leave from feeling energized and ready to do something great.

We would also like to thank our Leadership sponsors, Microsoft and HighRoad Communications.

I am hanging out at Idee where they are demoing their new iPhone application.

I am hanging out at Idee where they are demoing their new iPhone application.

I have to say I am impressed. The application allows you to take a picture of a CD (books and other products coming soon) and the app will then come back with pricing and other information. In the case of a CD, you can sample the tracks and buy them directly from the iTunes store.

After seeing TinEye, a lot of people have asked “what is the killer app for search?”, I really don’t have an answer, because it isn’t really the kind of stuff I think about, but this represents the kind of innovation and interesting applications that can come out of this kind of technology. This might not be the killer app itself, but it shows that there are dozens of problems that Visual Search can solve.

After seeing TinEye, a lot of people have asked “what is the killer app for search?”, I really don’t have an answer, because it isn’t really the kind of stuff I think about, but this represents the kind of innovation and interesting applications that can come out of this kind of technology. This might not be the killer app itself, but it shows that there are dozens of problems that Visual Search can solve.

The message I got tonight was that Idee is just getting started in building tools that make use of their core visual search technology, and that we are going to be seeing a lot more in the months and years to come.

This iPhone application should be available within a few weeks, depending on how quickly the iTunes store approves it.

Leila Boujnane, Idee’s CEO, will be speaking at StartupEmpire in November.

HomeZilla, a real-estate companion site, is launching publicly today. When I first saw the site back in February of this year, it still had a long way to go in terms of usability, and it looks like they have really been working hard in the time since then.

HomeZilla, a real-estate companion site, is launching publicly today. When I first saw the site back in February of this year, it still had a long way to go in terms of usability, and it looks like they have really been working hard in the time since then.

It is practically impossible to do anything worthwhile online for the real-estate market in Canada. The Multiple Listings Service is a monopoly and the ultimate gatekeeper of listings data. They protect themselves with anti-competitive contracts and stifle any sort of innovation. They regularly shut down websites and startups who come up against them. The most famous of which was the Real Estate Plus project by Bell Canada.

So, what do you do if you are passionate about this market, but can’t play fair? You go around the bullies and provide value in other ways.

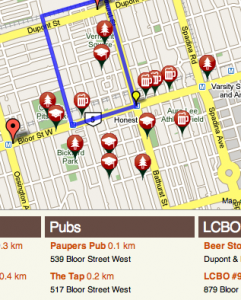

HomeZilla provides neighborhood information that helps you make a decision about where you want to buy. Where are my local pubs? Schools? Child Care? LCBO? It is all in there.

The Toronto based company has a lot of work ahead of them to get exposure during a time that has seen real estate purchased drop like a rock in Toronto (down 22% to 30% by some estimates) and other cities. That said, I think HomeZilla will play an even more important role for a new type of buyer who will be a lot more picky about where they are purchasing, and they will have time to browse around, rather than bidding on every house that comes on the market.

I do not know exactly what HomeZilla’s revenue model is, but I can think of a handful of obvious opportunities to provide add-on value for real estate agents.

Personally, I think we need more startups like this, who demonstrate the possibilities of what can be done in the real estate space, and who I hope will collectively give a big middle finger to the MLS monopoly.

HomeZilla was founded by former Yahoo! manager Sandy Ward, who recently returned to Toronto from San Francisco.

After what seems like a very short summer break, things have started up again at the Maple Leaf Angels. We held our first investment breakfast of the season in September and look forward to another great season of seeing great companies and closing deals. Since the group was started in early 2007, Maple Leaf Angel members have made investments in over 10 companies.

One of the functions of the board is to do company screening and select the companies that will present at our investment events. Having seen pitches ranging from very good to very bad, I thought I would start off my first post of the season with my top 5 do?s and don?ts of securing investment.

1) Do start early – raising money takes time

Remember that the timeline in the referenced article assumes you go from start to finish and close the deal. You may very well find you get part way through the timeline with one investment group only to be turned down. That means you need to start over again with alternate groups. The best time to look for financing is when you are in a position of strength (i.e. things are going well with your company) and not when you are in dire need of financing to survive.

2) Do ensure you have the fundamentals down pact (product, market, competition, management, financials, goto market)

Throughout the funding process investors will want to gain a comfort level with a potential investment in your company by assessing these areas. Not being prepared with details will seriously weaken your prospects of getting funded.

3) Do be memorable for the right reasons

During the early stages of the investment process, the goal is to stand out from the other companies pitching and get people interested in your company to want to spend the time to undertake a due dilligence process. At any organized investment event you will be one of many companies presenting to a group of investors. All will be pitching with the same message (our company has a great new idea, that can be sold to a large market, and make a lot of money). Often time the amount of interest you garner is largely dependent on the person who is presenting. You have probably all been to industry conferences & events where you have sat through presentations where you had to try hard not to doze off. But every once in a while you have attended a presentation with a great speaker that you leave feeling energized and challenged. This is the type of person you want to give the pitch to get people interested and excited about investing in your company.

4) Don?t have an unrealistic idea on valuation

Valuation can be complicated and difficult to determine an exact value for your company. However, when you are first asked what your valuation is, do not give an unrealistic number if you are an early stage company (i.e. a pre-revenue company is generally not going to support a valuation in the 8 figure range). Also, if asked about valuation during your initial meeting, always preface it that it is open for discussion. At this point each side is only just beginning to get to know each other and what they bring to the table. Being adamant about an unrealistic valuation number (usually mistakenly rooted in the belief of not wanting to give up more than 51% of the company as to retain control) will quickly cause people to loose interest.

5) Don’t have people walk away from your pitch presentation without having a clear idea on what your company does and how it makes money

Even if your product is a very technical product, you need to be able to clearly articulate what it does, what pain point it is solving, and how your company makes money. You would be surprised how many pitches I have sat through and left without having a clear idea on what the company did. If you cannot cross this basic hurdle, your chances of getting investment are going to be very slim.

Seems pretty basic – right? You would be surprised how many pitches get passed over as a result of tripping up over one of the above points. The ability to secure funding will play an important role in your company?s strategy and growth. Make sure you put your best foot forward!

I attended some of the sessions on Wednesday for Toronto Tech Week, here are my notes from Albert Behr’s session on exit strategies:

“If you don’t know where you are going, you might not get there”. Was the headline advice at the “Designing for Liquidity” startup day event of Toronto Tech Week. Kudos to the organizers for pulling together some great startup content, the day was a great warmup for startupempire soon to come.

The Liquidity event panel had good stuff from Tim Lee of Gowlings on the legal side of selling your company (hint: you’ll need a lawyer), Tim Lee of GrowthWorks on the VC perspective (yes virginia, there still is VC activity in Canada, just as much as pre-bubble …but… to fewer companies and you can forget about early stage, how you raise your first 0-4M is your problem, learn to love angels, government handouts and your bootstraps). But the real barn burning presentation was Albert Behr on how to get from zero to sold in three years. Here’s my hasty notes:

First off: the IPO is dead. SOX killed the IPO, so did the bubble. There’s only two ways to a happy ending these days, keep running your company into the sunset or get bought out.

Tech is still a great market. 3 Trillion a year. But here’s the challenge. We’re 30 years into the industry and it’s now an oligopoly. Doesn’t matter what tech you build there are only, maybe 30 players out there that matter that are your exit strategy for acquisition. And the list is getting smaller, the list of companies on the Nasdaq is down 25%.

And the tech cycles are getting faster. You are only hot when you are hot, you will never be hot again. There’s only one company in the history of tech that has been hot twice, and that’s Apple. You are not Apple. You have maybe 3 years, or 30-36 months to make it. So build a 3 year business plan and get the hell out there. Forget 5 year plans.

Here’s the strategy. Choose you 2-3 likeliest suitors and and “antagonize” the hell out of them until they buy you.

But remember we are Canadian we have to play to our strengths. Everyone makes the same mistake and tries to sell direct. Canada is great at producing engineers, we are not good at scaling. Do not go toe to toe with direct sales forces of your American competitors, they will have 3 times as much money, they will blow you out of the water (anecdote, one time I raised 27M, a lot of money for a canadian company right? Wrong, my one competitor raised 90M, the other 140M. I had one sales guy in NYC, they had 14. Don’t take the market head on.

Instead, build your channels, license your technology, go the OEM route. Don’t worry about margins 100% margins of nothing is still nothing. All that matters is footprint, getting your stuff distributed. You’ve got only 30months to get your product on to every “Walmart shelf” [insert top three distribution channels for your industry here].

So first, lock down your IP. This is very important. Provisional file everything, it’s not free but it’s not that expensive either. Provisional filings are cheap, do it in Canada, the US and Europe. In Albert’s companies he gives the CTO’s quota’s of 1-2 IP filings a quarter.

Canada is good for starting out, build your first 0.5M in revenue here, not to prove that the distribution works, but that the technology works. The dogs will eat the dog food. That the product/beta is ready. Then look south, focus on (only) the US and western parts of Europe. You need the distribution deals here to drive you to the 5-10M revenues where you start to become interesting to acquisitors.

Tightly integrate your stuff with 2-3 existing players, both technically and businesswise. Create the app that gives blackberry an edge over iphone, give microsoft an edge over IBM etc.

Then go to the big guys with a deal. Don’t be a Canadian wimp, use linkedin and go straight to the general manager or VP in charge. In the US they do deals, if you have something that might grow their business, they will give you 10 minutes of their time. White label your technology, let them slap their brand on it. (Only after you’ve locked down the IP). Make it a product that brings them incremental sales, and or a competitive edge.

Use exclusivity deals, but tie it to revenue targets and make it time limited so they have incentive to move it and you get your product back if they don’t.

Then, this is how you antagonize them. They’ve now outsourced engineering to you by proxy. As the sales grow and they keep having to pay royalties, they will see where this is going and you’ll drive their CFO crazy. The company will come to you to buy you out. Sell at 4x revenue multiple and move on, next company…

easy right?