My previous article on start-up funding sources covered Precarn. For the next article in this series, I will cover The Health Technology Exchange (HTX). I recently met with Norman Pyo, director of business development and investment to have a discussion on HTX.

Craig: Thanks for taking the time today to speak with the StartupNorth readership. To start, can you give the ’30 second elevator pitch’ on The Health Technology Exchange?

Norm: HTX is a not-for-profit organization that is funded by the Ontario Ministry of Research and Innovation. Our goal is to support innovation and commercialization in the Medical and Assistive Technology (MAT) sector in Ontario. Companies in this sector are working on things such as medical devices, medical imaging and laboratory devices. In this space we also have companies that are working on software oriented initiatives that the StartupNorth readership may relate to. Examples include healthcare IT systems to manage chronic disease conditions or remote monitoring by connecting personal medical devices to wireless devices such as the Blackberry. We support MAT companies through various programs that provide mentoring, grants, networking opportunities and events.

Craig: So in terms of eligibility, companies need to be Ontario based?

Norm: Yes, companies need to be based in Ontario for us to be able to fund them through our R&D programs; however, we work with organizations across Canada to provide linkages. We also focus exclusively on the MAT sector so we would refer other life sciences companies, such as those in the pharmaceutical or biotechnology industry, to organizations such as MaRS.

Craig: What’s the best way for a company to engage HTX?

Norm: We have three advisors at HTX, each with extensive and complementary backgrounds in the healthcare sector that provide mentoring on issues relevant to start-up medtech companies such as strategic planning, product/clinical development, regulatory strategy and early stage finance. Companies who are not referred to us should make initial contact with the HTX office. From there, they will be connected with an advisor that best fits their needs, in terms of expertise and geographic location. We mainly see early stage companies, so we actively work with the companies to understand what they are trying to achieve and see how we can use HTX resources to support them. This can include providing mentoring advice or making connections to industry partners and teaching hospitals/universities. We also run events on medical technology topics such as regulatory approval and discussion panels with CEO’s of companies in the space who talk about overcoming common hurdles and sector-specific challenges.

Craig: Can you talk about the funding programs you have?

Norm: We currently have three distinct funding programs: the Business Investment Program, the Health Technology Assessment & Implementation Program and the Clinical Validation Program. Each program has a specific focus for use of funds, all of which support advancement and commercialization of MAT initiatives.

Craig: Ok, let’s start with the Business Investment Program; can you talk about how this works and what its purpose is?

Norm: Yes, the Business Investment Program is meant to fund R&D within the MAT space. The program is funded by HTX, OCE and IRAP and provides up to $100K per project. Companies need to apply to the program with a specific project and have a publically funded research institution in Ontario lined up to perform the research. Companies much match the grant amount with 1/3 of their own money as well as 2/3 of in-kind contribution towards the project’s costs. In other words, HTX will fund up to 50% of the project’s cost and these funds will be directed to the research institution to help fund the R&D objectives of the project. Examples of past companies that have received this grant include Quantum Dental Technologies, GestureTek, and Quillsoft. An example of a company that has been awarded a grant under this program is Quantum Dental Technologies. Funding from this program helped to advance Quantum’s Canary System, which provides early detection for tooth decay, without the traditional use of X-rays.

Craig: For 2009, the initial application phase of this program has just closed. What happens next?

Norm: Correct, the call for Expressions of Interest (EOI) for the Business Investment Program closed this July. After the submissions are received, the funding partners (organizations that contribute funds to the program) meet internally to review the submissions to select the most promising projects. Those companies that make it to this next phase will then submit a full proposal. These proposals are reviewed by external reviewers who are familiar with the company’s space and that have a deep understanding of what the project is looking to achieve. Proposals are vetted against the capabilities of the company and research partner, past track record of management and its commercialization potential. Upon validation, the grant is awarded in a tranched fashion based on project milestones. The projects must be completed within a 6 to 18 month period.

Craig: To be clear, the grant is not directly paid to the company?

Norm: Right, typically, the company’s cash contribution is paid to the institution. The company’s costs over and above this are in-kind.

Craig: What is the next program planned?

Norm: We will be requesting Expressions of Interest (EOIs) for the Health Technology Assessment & Implementation Program this August. The purpose of this program is to support the acquisition and assessment of market-ready MAT products by Ontario hospitals. In other words, the program helps fund a hospital’s acquisition of a MAT product, and in return the hospital becomes a reference customer for the company’s product. Similar to the Business Investment Program, applicants can receive up to $100K per project, which must also be matched by the combined contributions of the company and the hospital/healthcare institution. The company provides a deep discount and the institution’s cost for evaluative services are recognized. The HTX contribution helps to defray the purchasing costs. Sentinelle Medical was a past recipient of this grant, and has successfully implemented their imaging technology into the Kingston General Hospital.

Craig: And the third program?

Norm: This would be the Clinical Validation Program. The purpose of this program is to fund clinical testing or validation studies of a MAT product within an Ontario Hospital. The maximum grant per project is $50K and must be matched by the company – with 80% being cash-contribution. Mespere LifeSciences was a past recipient of this grant. Mespere develops a non-invasive hand-held device to measure central venous pressure in real time; replacing the traditional expensive, invasive and infection-prone procedure of catheterization. We have launched this program through partnership with regional innovation organizations such as BioDiscovery Toronto, YORKbiotech, and The Golden Horseshoe Biosciences Network.

Craig: If a company is ultimately selected for one of these programs, how long does it typically take to work through the process and get the cheque?

Norm: This depends a lot on the project being proposed, but it typically takes between 2-4 months.

Craig: How long have these programs been in place?

Norm: We have been running funding programs since 2004 and to date have provided $8 million in funding disbursements and helped fund over 70 projects. Approximately 1/5 of this has been for healthcare IT related projects. Example of healthcare IT initiatives funded include: MedManager Interactive, HInext, and Quillsoft, who all offer innovative solutions to distinct healthcare issues.

Craig: Great, thanks for taking the time to speak today. In closing, do you have any words of advice for entrepreneurs that want to get into the MAT space?

Norm: The MAT space has some unique angles given the public nature of healthcare funding, privacy issues and requirement for clinical research validation. That being said, there are a lot of interesting problems to solve and a lot of opportunities to provide innovation in the space through software or wireless technologies. HTX is here to help support entrepreneurs commercialize their ideas.

craig at mapleleafangels.com

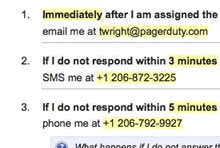

I love how it works. To use it, you sign up using a one-page form, and you’re then set up with your own account (accounts are free during their beta, but it’s not clear how long they’ll be in beta). You then set up your own alert software to send emails to PagerDuty whenever you want a notification (this is the most time-consuming part because you’ll need to set up each monitoring software individually). PagerDuty doesn’t do the actual monitoring; rather, it receives alert messages via email and routes them to the right person on your team based on rules you build. Alerts can be in the form of SMS, phone calls, or email.

I love how it works. To use it, you sign up using a one-page form, and you’re then set up with your own account (accounts are free during their beta, but it’s not clear how long they’ll be in beta). You then set up your own alert software to send emails to PagerDuty whenever you want a notification (this is the most time-consuming part because you’ll need to set up each monitoring software individually). PagerDuty doesn’t do the actual monitoring; rather, it receives alert messages via email and routes them to the right person on your team based on rules you build. Alerts can be in the form of SMS, phone calls, or email. One of my favourite parts of the software is the great UI on the built-in calendar that allows you to set up which person on your team is on-call at any time.

One of my favourite parts of the software is the great UI on the built-in calendar that allows you to set up which person on your team is on-call at any time.

That was fast! Earlier today

That was fast! Earlier today  J2Play was funded by Toronto’s

J2Play was funded by Toronto’s