- RT @phankinson: Tether is now the #1 top paid application on BlackBerry AppWorld (on the BlackBerry)… That was quick! #

- Just had my butt handed to me in squash a 6 games in a row . . . #

- RT @tpurves: Pssst it's Live! CommunityLend Canada's social-lending bank killer is now alive http://bit.ly/7VLgJE < congrats! #

- RT @sgblank Victory From Adversity: http://wp.me/prGQZ-1cm #

- RT @RobOstfield: We're excited to announce that @Jordan_Banks Thunder Road Capital has made an investment in @andpop http://bit.ly/4ZEg67 #

- RT @startupcfo Blog Post: Internet Sector Funding Report http://bit.ly/5Wbv1L #startups #funding #internet #

- RT @thoughtfarmer screenshots of ThoughtFarmer 3.6 on Flickr: http://bit.ly/5ffTLu. #thoughtfarmer #3.6 #launchday #

- Why @HubSpot won't exhibit at Tradeshows & Events anymore? http://bit.ly/6TwkUx #marketing #metrics #

- RT @RICCentre: Raising capital from local angels & VCs? Breakfast session on Jan 20th! Visit http://bit.ly/74KGfx #peelregion #gta #

- RT @suziedingwall: Exit trends: earn-out provisions are used ~100% of the time to deal w/ gaps in perceived value between startup & acquiror #

- RT @bwertz @TechFlash: Amazing list of Seattle startups started by RealNetworks alumni http://bit.ly/4ZawJq #fairchildren #

- RT @rayluk: Meeting with @RogersVentures this morning < this is a powerhouse meeting #

- RT @sgblank: A Startup is Not a Smaller Version of a Large Company: http://wp.me/prGQZ-1du #

- RT @leilaboujnane iStockphoto & Photoshelter fully integrated in TinEye index! Attribution is your friend http://bit.ly/6I4ARm Go #TinEye #

- RT @rhh New post: Organization – The Shareholder Agreement: http://bit.ly/8x7LJk #

- RT @jacquimurphy *Drumroll !* RT @postrank: Announcing the PostRank Top Blogs of 2009! http://bit.ly/5syOxx http://bit.ly/4X8jb0 #

- RT @mastermaq @CityofEdmonton: Microsoft highlighting the great work the #yegdata team is doing http://bit.ly/5lJVRi! #

- RT @VCMike: New Blog Post: The Product Guy Myth http://bit.ly/7i0aJm #

Search results for: “communitylend”

-

Week in Review

-

Week in Review

- 10 Things you can learn from Lady Gaga http://bit.ly/7FsooZ #

- New job posted: Business Development Lead / Assetize / Toronto, ON, Canada http://bit.ly/87c5gf #

- Great coverage of @CommunityLend in the Financial Post http://bit.ly/55tg9t #toronto #startups #

- True Growth Capital never takes a holiday – http://bit.ly/8l1mee #

- What's the right amount of seed money to raise? by @cdixon http://bit.ly/6cn5Uj #startups #fundraising #

-

More Crowdsourced Capital – Colektivo readies for launch

Colektivo is a new debt-financing startup that appears to be attempting to bridge peer-to-peer loans with crowdsourced investing. A sort of Kiva for entreprenurs, bridging the concepts behind startups like CommunityLend and Vencorps. Startups are asked to fill out a loan application, and a group of lenders then decide if they want to make a loan to that startup.

Colektivo is a new debt-financing startup that appears to be attempting to bridge peer-to-peer loans with crowdsourced investing. A sort of Kiva for entreprenurs, bridging the concepts behind startups like CommunityLend and Vencorps. Startups are asked to fill out a loan application, and a group of lenders then decide if they want to make a loan to that startup.Colektivo runs the first investment fund on the Internet managed by a group of investors. The investment fund sole purpose is to supply local small and medium enterprises (SMEs) with debt financing. This synergy between SMEs and savers represents a real alternative to banks and traditional investment products. The incomes of interest generated by the loans are redistributed to the savers whereas the principal portion is reinvested in other SMEs. With a minimum investment of 100$, investors are able to buy investment fund units

My first impression is that Colektivo is taking the worst from both worlds and attempts to bring them together to form an idea that seems full of risk and that promises minimal reward.

The peer-to-peer loans industry has been under a lot of pressure and has lived under a cloud of uncertainty in almost every jurisdiction so far. Prosper.com was shut down by the US SEC in November 2008, and in Febuary 2008, IOUCentral launched and was then quickly shut down here in Canada. My sense is that they are trying to avoid regulatory hell by managing it as an investment fund, which may or may not work, I am not qualified to say.

So, take the peer-to-peer model, and then layer on the further uncertainty of the crowd-sourced investment model and I get jittery. I hope they can prove me wrong though.

I am, however, feeling more and more bullish about Vencorps, which uses crowdsourcing to find good investment opportunities, but which uses its own money to make the actual investments. I have been watching some of the pre-launch contests they have been running, and I do see the potential.

-

Distinctly Canadian Web Habits

This is a guest post by CommunityLend.com CEO Michael Garrity. We have profiled CommunityLend in the past.

There was a great piece in Saturday?s Globe and Mail outlining the contrast in the opinions of Canadians and Americans on who got the short end of the stick on the Free Trade Agreement. Predictably, both sides think the other is making out better (which in my own political experience is usually a good sign that things are about equal).

Reading the story did get me to thinking about other contrasts between ourselves and our American brethren, here on the week of both of our national patriotic celebrations. Further, as the CEO of a web company focused on the Canadian market, the story specifically got me thinking about the differences between our two nations? general usage patterns on the web.

To get some informational guidance on the issue, I went to Alexa and pulled the Top 100 most visited US sites and compared them to the Top 100 most visited Canadian sites. The net result of this imperfectly empirical study is what I?ll call ?Michael?s 5 Observations on National Web Behaviour? (just to give it a flashy and important title). I share these unique and clearly very important observations with you here in joint celebration of our National Holiday.

Observations on National Web Behaviour:

- Plus ca change… : The clearest observation from the two lists is that we share most of the same online pastimes as our American web surfing neighbours, especially on the top end of the list. The majority of the top sites on both lists are predictably all the big names in Search, Social Networks, Auctions, File ?sharing?, Online Gaming and of course, Porn. Two notable Canadian distinctions; we tend to use the .ca extensions of the big names (e.g. google.ca) and our number one social network by a LONG SHOT is Facebook, coming in at the number 2 spot overall after the big G. MySpace, picks up the 11th spot, just beating …

- Peace, Order and Good Government: The biggest surprise to me on the Canadian list is that the 13th spot is the Government of Canada website. Yes, you heard that correctly, the spot right after MySpace and eBay. My only explanation I have for this distinctly Canadian behaviour is that there are just so many departments and agencies and forms and services provided by the Canadian government that these sites have become an easier way to navigate it all. By comparison, the only US government service on the US Alexa list is USPS at number 72, presumably folks trying to locate their lost mail.

- Mosaic Nation: They are the ?melting pot? and we are the ?mosaic?, or at least that?s the story we have been taught in school. The question is does it hold up online? The answer seems to be ?yes?. While 100% of sites on the US Alexa list are unilingual English, about 10% of Canadian Alexa 100 are sites that are specifically non-English (not to mention all of the sites that offer two languages as an option). Top on the list at number 56 is the French site Meteomedia.com and next is number 64, Sina.com, all in Chinese.

- Minding the Books: Canadians top the world in usage statistics for online banking and it bears itself out at Alexa. The first Canadian bank comes in at the 21st spot (TD Bank) then they pepper the list until the end. Contrast this to the US list where the first bank comes in at the 38th spot (Bank of America). Yes, it seems we are a nation of book-keepers, bouncing actively between our Facebook profile updates and our bill payment screens. An exciting lot, us Canadians. Good news is that this should bode especially well if one had, say, an internet start up focused on the Canadian financial services space … say.

- And Speaking of Start-Up?s: How do Canadian start-ups fare on the list? Well, not exceptionally well. There are three I can see. At 59 comes plentyoffish out of Vancouver, then at 91 it`s Toronto?s own redflagdeals.com, followed by Edmonton?s nexopia.com at 92. It should be noted here that there is certainly no shortage of criticism related to Alexa as an accurate measure of web usage so I?m sure other start ups will have at it for not being on the list. In the meantime, the list shows that there is still a lot to strive for in our community in getting the numbers up for our respective services.

- Plus ca change… : The clearest observation from the two lists is that we share most of the same online pastimes as our American web surfing neighbours, especially on the top end of the list. The majority of the top sites on both lists are predictably all the big names in Search, Social Networks, Auctions, File ?sharing?, Online Gaming and of course, Porn. Two notable Canadian distinctions; we tend to use the .ca extensions of the big names (e.g. google.ca) and our number one social network by a LONG SHOT is Facebook, coming in at the number 2 spot overall after the big G. MySpace, picks up the 11th spot, just beating …

-

IOUCentral – P2P Banking isn't always so simple?

Well, that didn’t take long. IOUCentral appears to have been essentially shut down by regulators here in Canada and they have disabled their loan and application functionality and are now repaying any fulfilled loans. The startup, which we covered, launched just a few weeks ago.

Well, that didn’t take long. IOUCentral appears to have been essentially shut down by regulators here in Canada and they have disabled their loan and application functionality and are now repaying any fulfilled loans. The startup, which we covered, launched just a few weeks ago.We are not aware of the specific “regulatory matter” that seems to have shut down IOUCentral, and I won’t pretend to know enough about the banking industry to comment, but we did ask them about regulatory issues when we first interviewed them earlier this month. At the time they indicated that their legal agreements should have provided sufficient operating cover. It now appears that wasn’t the case.

In a recent Toronto Star article, IOUCentral competitor CommunityLend indicated that they were focusing on making sure that regulators were satisfied before their launch.

” . . .CommunityLend executives hint they will have an edge because of the time devoted to satisfying a host of regulators across Canada.

Marleau of IOU Central, however, is under the impression “there is no watchdog watching this business.” . . ”

This now puts IOUCentral back in the race with CommunityLend and PeerMint among others to become Canada’s first peer-to-peer lending operation.

We have asked IOUCentral for comment and will update this post with anything they have to say.

-

IOU Central – Canada gets its first Peer to Peer Lending Company

IOU Central, a Montreal based startup, is launching today. They have staked their claim as Canada’s first Peer to Peer lending company. We covered the funding announcement of Toronto based CommunityLend back in December.

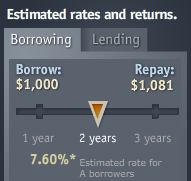

IOU Central, a Montreal based startup, is launching today. They have staked their claim as Canada’s first Peer to Peer lending company. We covered the funding announcement of Toronto based CommunityLend back in December.Peer-To-Peer lending has been maturing quickly as a concept on the heels of successful sites like Zopa and Prosper, but Canada has so far had no such providers. Peer to Peer lending is a concept that takes a large group of lenders who are willing to lend out smaller amounts of cash and connects them with borrowers who need access to cash at a rate that is below the standard credit card rates, but they are generally willing to pay a higher rate than if they had to go to a bank. A lender can be anyone with a bit of extra cash that they would like to get decent returns on.

From a borrower’s perspective, IOU Central operates much like any other lender, in that a borrower’s initial “rating” is based primarily on their credit score. You can however supplement that score by uploading a number of other documents to do things like prove your income, itemize your monthly expenditures and other things that can bump up your overall score.

From a borrower’s perspective, IOU Central operates much like any other lender, in that a borrower’s initial “rating” is based primarily on their credit score. You can however supplement that score by uploading a number of other documents to do things like prove your income, itemize your monthly expenditures and other things that can bump up your overall score.IOU Central groups borrowers into 5 tiers: A, B, C, R, and HR. Borrowers in each tier pay IOU Central a service fee on top of the loan of 1%, 1.5%, 2%, 2.5%, and 3% respectively. Service fees varies because IOU Central expects to have to spend more to recruit lenders interested in higher risk borrowers and expect to face higher operating costs servicing loans to higher risk borrowers.

IOU Central charges Lenders a Lending Fee, which works out to about 0.5% annualized, calculated based on the amount of outstanding loans you have remaining each month.

The company was conceived over a year ago and their site has been in development for just under a year. There are currently 7 full time employees and they have raised a round of funding which includes Angels and VCs, but they did not disclose the amount of funding.

I asked Sam Bendavid, VP of Business Development for IOU Central, what sort of regulatory or legal issues they encountered running up to launch and he indicated that things were quite smooth. IOU Central is registered in Quebec as a lender and they worked closely with their law firm in developing their set of Legal Agreements.

IOU Central will be focusing most of their initial marketing on potential lenders. This is a smart move as lenders will be far more scarce than borrowers. Perhaps the days of getting a loan from Uncle Vinnie are over, and Canada now has a safe, regulated, and legal place to secure peer to peer loans.

Update: The Star provided some further coverage a few days later.