Last week we got our finance on at Game On, a top notch event by Interactive Ontario that brought together thought leaders from the games business. Right from the start it was apparent the games industry is incredibly diverse.

Over half the attendees were in the console game business, by and large a mature industry. More than a few people didn?t appreciate their industry being called mature? but what else can you call it when $15 million is required to create a new console title and there is virtually no way to get a project financed without the backing of an established publisher like Ubisoft or EA. “The large investments required rule out venture capital interest” noted Randy Thompson of Argon Venture Partners, so financing a title more closely resembles feature film (without the promise of Hollywood glamour). Eric Zimmerman, Co-Founder of Gamelab, made a particularly incisive point by posing the question ?do ever more realistic lumbering 3d giants really drive greater entertainment value??

Also in attendance were developers of mobile games. The mobile games business is currently controlled by carriers who use their decks (the preset homepage and application managers) to strong arm developers, control billing, limit distribution, and take a hefty cut. The challenges of mobile game developers are many, perhaps the most significant being porting (ensuring a game will work on the 1,500+ mobile phones on the market). Phil Giroux of Magmic Games, one of the most successful mobile game companies out there, noted Magmic spends significantly more time porting than creating new titles. There are definitely some opportunities in the mobile space for startups, but my guess is that they involve less game development and more figuring out how to ensure games work across devices. How many of you have tried entering the mobile application space? Have any of you succeeded?

By far the most exciting space at least as far as startups are concerned is internet gaming. The flash enabled browser represents a distribution channel larger than xbox, playstation, and wii combined. There are of course challenges, internet users have grown accustomed to free. John Walsh, CEO of Groove Media, really blew the crowd away with their plan to monetize free games with in-game advertising and upgrades. Others must also be impressed, the Toronto based Groove Media has already raised $30 million, talk about taking it to the next level!

By far the most exciting space at least as far as startups are concerned is internet gaming. The flash enabled browser represents a distribution channel larger than xbox, playstation, and wii combined. There are of course challenges, internet users have grown accustomed to free. John Walsh, CEO of Groove Media, really blew the crowd away with their plan to monetize free games with in-game advertising and upgrades. Others must also be impressed, the Toronto based Groove Media has already raised $30 million, talk about taking it to the next level!We met a great group of Canadian entrepreneurs at Game On Finance. Vikas Gupta of Transgaming Technologies, John Walsh of Groove Media, and Nathan Gunn of BitCasters. We?ll be following up with profiles of each over the next few weeks, cause one thing is for sure, Canadian entrepreneurs will be behind the next revolution in gaming.

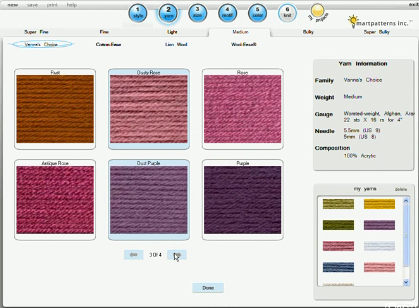

I wasn’t exactly sure what to think when I first took a look at

I wasn’t exactly sure what to think when I first took a look at

2-3 weeks later two packages will arrive: a welcome kit (which includes a fingerprint scanner and a copy of the book Anne of Green Gables) at the parents home and a password card at the sponsors home. The sponsor then must call the parents to reveal the password. And that is just the sponsorship piece.

2-3 weeks later two packages will arrive: a welcome kit (which includes a fingerprint scanner and a copy of the book Anne of Green Gables) at the parents home and a password card at the sponsors home. The sponsor then must call the parents to reveal the password. And that is just the sponsorship piece. A subscription to Anne’s Diary costs $119.99 a year. For comparisons sake, Club Penguin costs $60 a year and Webkinz $15. The games on Club Penguin are actually pretty fun and you get to play with other penguins! With Webkinz, you get a physical stuffed animal even before you register!

A subscription to Anne’s Diary costs $119.99 a year. For comparisons sake, Club Penguin costs $60 a year and Webkinz $15. The games on Club Penguin are actually pretty fun and you get to play with other penguins! With Webkinz, you get a physical stuffed animal even before you register! So what does being “the first biometrically-secured social networking site for children in the world” mean in terms of security? We’re not exactly sure… The issue is content not authentication. What’s to stop Uncle Lester from using a logged in but unattended computer?

So what does being “the first biometrically-secured social networking site for children in the world” mean in terms of security? We’re not exactly sure… The issue is content not authentication. What’s to stop Uncle Lester from using a logged in but unattended computer? Celtic House Venture Partners, EdgeStone Capital Partners and Tech Capital Partners announced today a Series A investment of $4,600,000 in

Celtic House Venture Partners, EdgeStone Capital Partners and Tech Capital Partners announced today a Series A investment of $4,600,000 in

In case you weren’t already aware, TIE Toronto (an entrepreneur support group in Toronto) is holding

In case you weren’t already aware, TIE Toronto (an entrepreneur support group in Toronto) is holding