This a.m. in Toronto, the folks at everyone’s favourite big red carrier, invited a collection of local developers and partners to give a sneak preview of their new carrier services API called Catalyst.

This a.m. in Toronto, the folks at everyone’s favourite big red carrier, invited a collection of local developers and partners to give a sneak preview of their new carrier services API called Catalyst.

At first swoopy-rosy-red blush, Rogers’ Catalyst looks almost oddly familiar to that old software branding of a certain other Markham-based technology heavyweight. Functionality wise however, Catalyst has a lot more in common with the similar multi-carrier initiative called OneAPI (also supported by Rogers btw). The difference with Catalyst is that it signals a split with OneAPI to give dev’s access to supposedly deeper/better but also proprietary integration with Rogers network. for now, these are services like messaging, location and billing. For developers, richer but proprietary api is either good or bad news, depending on your appetite for carrier-specific app development. Rogers and Fido may be Canada’s biggest mobile operator. However, tying your app to their network is obviously no way to reach every Canadian, let alone the world market.

Those caveats aside, there is good stuff in this API. First up, everything is build on web and “SOAP and restful standards” promising to abstract away historically crufty telco interfaces, dedicated lines and slow/expensive integration certification.

Functionality wise in this release we get:

- Messaging: Web-based SMS origination, SMS delivery confirmation, and “instant” shortcode provisioning

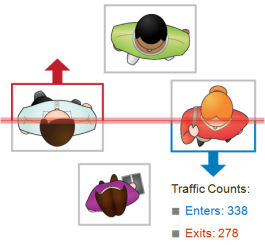

- Location: Server calls at various levels of accuracy vs speed that allows your cloud to geo-locate and track any handset on the network. A scary thought, but the service also comes with built-in opt-in and privacy controls.

- Billing: the ability to bill up to $100/month to Rogers bills for apps or content. The revenue split is 30% Rogers, 70% developer, no need for CWTA shortcode to start using billing

- More stuff, apparently coming soon

So what does it mean for entrepreneurs and tinkerers? Sure you won’t yet take over the whole world with Rogers-only API integration. However I see a few great use cases: as fast/cheap proof of concept sandbox before you invest in scaling your app with many carrier integrations, for enterprise app development, for academic or mobile research projects. Now if only Rogers would also provide subsidized (or at least more flexible) hardware, sim cards and data plans with their developer programs they’d have a real winner. Where are our api’s for Canada’s aspiring hardware hackers I’d like to know? Where are our api’s for helping us do real commerce over mobile not just virtual goods? I may just be biased, maybe we’ll get there in time.

The big picture here is we are seeing carriers trying to claw their way back into digital content value chain. It remains to be seen how well a single carrier can compete on alerts, location and content billing which, let’s face it, all smartphone platforms nowadays support some pretty decent version of natively. But notionally that’s fine. More choice and competition is good for developers. I’d like to see more big companies opening their kimono’s and offering up interesting APIs. Once they’re in the wild, have at the Rogers Catalyst APIs and let me know what you think.

Rogers Catalyst Beta is not publicly available just yet, but should be launching in beta form within a week or so at rogerscatalyst.com

Some great news for Ontario, and the national startup community, today. We are hearing from multiple sources that John Ruffolo will be joining

Some great news for Ontario, and the national startup community, today. We are hearing from multiple sources that John Ruffolo will be joining

MontrealStartup

MontrealStartup