This is a guest post by Patrick Hankinson, the CEO/Founder of Compilr.com a Halifax based startup building an online IDE which has almost 100,000 users. Patrick is also a co-founder of Tether.com.

In early 2011, I met an entrepreneur and angel investor from London, at a Starbucks in my small province. He literally just took the red-eye from London, I could tell by his blood shot eyes. He wanted to know what I was working on and I explained what I was working on an “online IDE for programmers”. I could tell immediately he didn’t know what an IDE was…

Talk about a pivotal experience. I was a programmer turned marketer, yet I still used very technical terms to describe what I was working on. The angel investor looked at me with a blank stare; he didn’t understand exactly what I was working on.

After another couple of minutes of questions, I explained and tweaked my value proposition. He finally understood what I was working, but exclaimed that I definitely need to work on my non-technical elevator pitch. Naively, I responded I’ll never need to pitch to non-technical people.

Now, I know that a non-technical pitch is critical. You may end up with non-technical investors like doctors, who will want to brag to their friends what they are investing in. You don’t want to put your doctor in a situation where they can’t explain exactly what you’re product does, killing viral potential. This is sometimes the case, because the investor is more in love with the team than the product.

After this, he explained an incubator from London was putting a session together in New York. The incubator was called Seedcamp. I’ve never heard of them before, I looked at them online, saw they had invested in a several companies and were considered a European Incubator. They definitely didn’t have any credentials like Y-Combinator or Techstars. In fact, the only acquisition that I saw, to date had beenMobclix.

I decided to apply to Seedcamp anyway since it New York was literally a 2 hour flight away (I had never visited New York, gave me an excuse). Plus it was at Google’s office in New York. Our product, Compilr, was definitely potentially a product to someday be acquired by a company like Google, Microsoft, Salesforce, Facebook, and the list goes on. Any visibility I could get at this stage was definitely worth it.

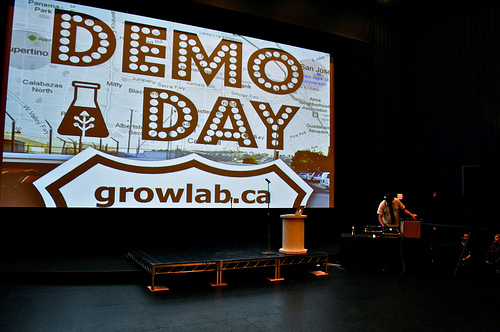

Compilr was accepted to present in New York to the Seedcamp list of mentors. We presented at Google’s office in front of 100 mentors or so. Presenting in front of 100 people was definitely not on my bucket list, but I got through it. It actually has helped in a lot ways. I’m definitely not worried presenting in front of 100s of people as much as I thought.

The day after, Compilr was invited to pitch to some of Seedcamp’s core investors. The room had maybe 15 people but I was more nervous than the day before. In all honesty, I thought I blew it because I was being asked a ton of questions. I answered them all, but Carlos, one of the main guys from Seedcamp had asked a question and I got sidetracked with an answer, when someone basically said “Well, ok thanks for your time, we’ll be in touch.” I still feel like a total d-bag because I didn’t answer his question…

At this stage I became defensive in my mind, even though I hadn’t received a yes or no to their investment. In reality, I didn’t care if I received Seedcamp’s investment or not. Personally, I was funding the company out of my own pocket, almost $150,000 a year, their small investment would only really marginally accelerate my company. I was hoping to get visibility in front of the right potential acquirers.

A few weeks later, I was in total shock when Seedcamp told me they were willing toinvest in Compilr. Even though, I personally felt like I blew the follow up meeting in New York. When I told several of my advisors, most of them were eager for me to take the funds. While some opposed to the idea, stating the same facts I alluded to earlier, onlyone successful exit, etc…

Our team decided to go ahead and take small investment from Seedcamp to use towards accelerating our business. Our end goal was that Seedcamp would present our company to potential acquirers like Facebook, Google to hopefully stimulate an exit, producing a positive ROI for them.

![]()

![]() Some rights reserved by miketippett

Some rights reserved by miketippett