Building a product and growing a startup is a different experience no matter where you live. In many ways every startup experience is completely unique and totally predictable all at the same time. The goals, struggles, opportunities and outcomes are each different and geography is one other thing that can be thrown in the mix.

Building a startup in Atlantic Canada IS different, for better and for worse, than Toronto, Austin, San Francisco or anywhere else.

IF you want to build a competitive, scalable, high-potential startup in Atlantic Canada then here are some of the most basic things I think every entrepreneur here needs to learn:

Get your butt on a plane

It is hard to understate this. Your customers aren’t here. Your partners aren’t here. Your investors might not be here. It is the nature of the place and you need to accept it.

Get on a plane and go see the people who are going to make your business, and you personally, successful. Every startup has different needs but it is best to err on the side of caution. If you are building an enterprise tech startup then you need to be in San Francisco. If you are building a media company then you had better be ready to spend time in New York. If you are selling to brands then I hope you like Atlanta and Minneapolis.

If you are fundraising then this is even more important. I’ve seen entrepreneurs lose a financing round because of a single bad phone call. It sucks but body language and a few dinner tables can make all the difference. Get out there, the world wants to meet you.

Government support doesn’t matter to the customer or your competitors

There are some really great programs available to support tech startups around here. Non-dilutive and relatively flexible IRAP, ACOA and other agencies really can be a great option. The fact is though that you are competing against world class startups who aren’t waiting for an application to get approved and who don’t need their SR&ED credits to make their next hire. Your competitors are moving at a lightening pace and you can’t afford to sit around.

You should be moving so quickly that you can hardly manage to get an application in for a project before you find yourself completing it. Government financing should be strictly secondary to acceleration capital which is going to help speed your execution.

You don’t need to compromise

Startups in Atlantic Canada should not compromise on anything. We don’t have to so we shouldn’t. We have been telling entrepreneurs not to put up with bad terms from local angel groups but the issue runs even more deeply than that. Focus on attracting the best investors and don’t put up with bad deals.

There is a tendency to confuse “we are different” with “we deserve different” here and while it’s ok to BE different we don’t deserve anything less than the best.

The talent pool is world class so you should hire world class

I have hired in a lot of talent rich places and I can say without exception that we have some phenomenal talent in Atlantic Canada. Like recruiting anywhere it can be gruelling. I got lucky: I hired Ben Yoskovitz. I didn’t hire him as a recruiter but he does it in his sleep and it has helped us scale without compromise.

Be picky and only hire those developers, designers, product owners and anyone else who you could drop in to a room in San Francisco, New York, Tokyo or Taipei and not have to worry about how awesome they will be. They are right here in your backyard to start looking and never hire less than awesome again.

… and finally

You are expected to take on the world

We do not need more me-toos and I’m not talking about lifestyle businesses here. Choosing to live and work in Atlantic Canada is not the easy road and it was never meant to be. We have built many world class companies here and we expect no less from you and your startup.

Making a dent in the universe is not only doable, it’s what you should be striving for. We should be leading the country and globally as a place that punches far above its weight. There is no reason to hold back, because the alternative isn’t a lot of fun.

Do not compromise on the size of your vision or the ferociousness of your execution. You should be audacious in your dreams because building a startup in Atlantic Canada is not about being in Atlantic Canada it is about being FROM Atlantic Canada, and that is a big difference.

These are just a few thoughts, but many of you have built startups here and in other places. What’s your experience and what are your tips for the next generation of startups we are seeing emerge now?

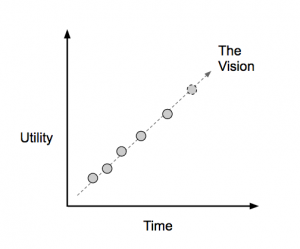

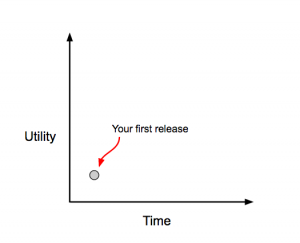

In a world of fast iteration and Running Lean, it’s easy to think of products as the entire picture. It’s one big giant dot that we hope brings us success and a mass of users.

In a world of fast iteration and Running Lean, it’s easy to think of products as the entire picture. It’s one big giant dot that we hope brings us success and a mass of users.