I was reading Eric Reis’ Lessons Learned blog yesterday and he talked about The Entrepreneur’s Guide to Customer Development. I begrudgingly read Steve Blank‘s Four Steps to the Epiphany, which is a must read for any entrepreneur (begrudgingly read because it is not the easiest reading). It is a great book, but it’s tough reading.

I was reading Eric Reis’ Lessons Learned blog yesterday and he talked about The Entrepreneur’s Guide to Customer Development. I begrudgingly read Steve Blank‘s Four Steps to the Epiphany, which is a must read for any entrepreneur (begrudgingly read because it is not the easiest reading). It is a great book, but it’s tough reading.

“And Steve is the first to admit that it’s a “turgid” read, without a great deal of narrative flow. It’s part workbook, part war story compendium, part theoretical treatise, and part manifesto. It’s trying to do way too many things at once. On the plus side, that means it’s a great deal. On the minus side, that has made it a wee bit hard to understand.” Eric Reis

I bought a copy yesterday based on Eric’s recommendation. It is a phenomenal resource for learning Customer Development. Patrick and Brant have done a great job writing an understanable how-to guide for using Customer Development and Agile Development in a Lean Startup. The book includes a shout out to our friends Dan Martell at Flowtown and Sean Ellis at 12in6.

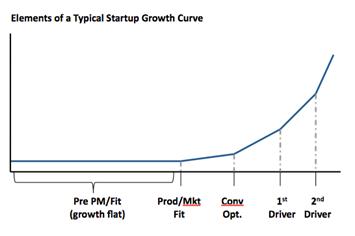

The book incorporates the wisdom and experience of real world practitioners of Customer Development in the 5 years since the inital publication of The Four Steps. For the first time a lot of entrepreneurs will hopefully begin to understand a technology adoption lifecycle and the marketing of products/services. I wrote a chapter in Cost-Justifying Usability back in 2005 where I had first encountered Steve’s Customer Development Methodology from his course notes in 2004 at Stanford (yeah, I know that’s crazy). In the chapter, titled “Valuing Usability for Startups”, I argued that getting out talking to customers and testing your hypotheses were key to success. However, I proposed using the Bell/Mason Diagnostic for evaluating the stage of corporate development in order to calculate Return-on-Investment of usability. In hindsight, I probably should have instructed entrepreneurs and usability professionals to look at processes like Customer Development to search for a “repeatable and scalable business model”.

The Entrepreneur’s Guide to Customer Development is a short mandatory introduction to using customer and agile development to search for a repeatable and scalable business model.

Discount for StartupNorth Readers

A few quick emails to Patrick today, and he offered to provide StartupNorth readers a 25% discount on any version of the book. First ten StartupNorth readers to go to CustDev.com can use the discount code.

Discount code: STARTUPNORTH (limited to the first 10 users)

Good luck!

How did we pull this off? Well the big shout out goes to William Mougayar at Eqentia, this would not have happened without the support and efforts of William. In case you haven’t seen Eqentia, they power custom portals for media monitoring, competitive intelligence, knowledge tracking and more. They power two sites that I use daily to track the Canadian emerging technology scene: CVCA and NextMontreal news widget. We’ll be launching a full Eqentia powered news portal in the next couple of weeks.

How did we pull this off? Well the big shout out goes to William Mougayar at Eqentia, this would not have happened without the support and efforts of William. In case you haven’t seen Eqentia, they power custom portals for media monitoring, competitive intelligence, knowledge tracking and more. They power two sites that I use daily to track the Canadian emerging technology scene: CVCA and NextMontreal news widget. We’ll be launching a full Eqentia powered news portal in the next couple of weeks.