I’m guilty. I’ve been pandering to my alma mater, the University of Waterloo. I love Waterloo and UWaterloo startups. There is so much to love. There are Vidyard, Thalmic Labs, TribeHR, Desire2Learn, PostRank (acquired by Google), . There is even a Waterloo mafia in Toronto with Upverter, Top Hat Monocle, SocialDeck (acquired by Google), PushLife (acquired by Google), Xtreme Labs (Amar, Sunny, Farhan are all UWaterloo 1998 grads along with Social+Capital‘s Chamath) and others.

But have you seen the awesomesauce that is originating at the University of Toronto:

- Bumptop acquired by Google, founded by UofT CS Masters student Anand Agarawala

- Sysomos acquired by Marketwire, founded by UofT CS prof Nick Koudas and Nilesh Bansal (UofT CS PhD candidate)

- BackType acquired by Twitter, founded by Christopher Golda and Michael Montano, both UofT Electrical Engineering Grads

- CognoVision acquired by Intel, founded by Shahzad Malik (UofT CS PhD)

- ScribbleLive cofounder Jonathan Keebler is a UofT CS grad

- Rypple acquired by Salesforce, founded by Daniel Debow (JD/MBA UofT) and George Babu (Engineering, MBA and JD)

- Canopy Labs founded by Wojciech Gryc a UofT grad

- Wattpad founded by Allen Lau (UofT Engineering) and Ivan Yuen (UofT MBA + UWaterloo Engineering)

- DNNresearch Inc. acquired by Google was founded by UofT prof Geoffrey Hinton and 2 graduate students

There are a number of spots on the UofT campus to find high potential growth startups and engineers. You can look at Creative Destruction Lab in the Rotman School of Business. You can look to the Entrepreneurship Hatchery in the Faculty of Applied Science & Engineering.

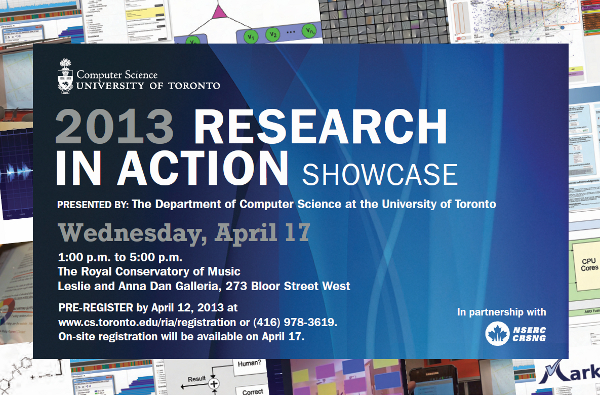

You can also attend the Computer Science Department’s Research In Action Showcase on April 17, 2013.

Add your events to our calendar.