I always like to say that a little vendetta is healthy for a startup. A vendetta, or keeping frenemies as Mark Suster wrote, can be a positive way to differentiate yourself if you understand the bigger picture. It is risky as part of of a company culture, but when you believe in something enough you can use it to your advantage.

I always like to say that a little vendetta is healthy for a startup. A vendetta, or keeping frenemies as Mark Suster wrote, can be a positive way to differentiate yourself if you understand the bigger picture. It is risky as part of of a company culture, but when you believe in something enough you can use it to your advantage.

Now, the term vendetta might be a little harsh at least by the letter of its definition. Perhaps frenemies is a little more more palatable.

The best playbook on this is Marc Benioff’s Behind the Cloud and Mark covers the rest in his post (especially the advice: Do not actually think your competition is stupid), so I will only add:

The bigger message has to be positive

Mark Suster mentioned Marc Benioff in his post. If you dig in on how Marc has positioned Salesforce against the rest of the industry it can, on the surface, seem very confrontational. The truth is that every jab Marc takes seems significant because he draws momentum from his very positive and forward thinking vision for Cloud Computing/SaaS.

Without that leadership then Marc might have been less endearing, but instead he gave more positive thinking and leadership than he did negative. That meant that when Salesforce did use negative tact (their logo is an example of negative messaging), then it was easy for the customer to understand where that negative message fits in to a larger picture. Without the bigger picture? It’s just negative.

Know what you are not

In my most recent startup we were stacked up against a handful of competitors during a “pitch day” to the executive of the customer. It was a “must win” deal for us but it was still a longshot because we were up against some well entrenched competitors who “owned” the industry. The truth is that we had harboured a quiet vendetta against these guys for ages and it drove us to understand their business as much as possible. “Competitive intelligence” was not something we did formally, but I realized at that moment that it had become a small hobby. We would research what the competition was doing, who they had doing it, and how their customers felt about it.

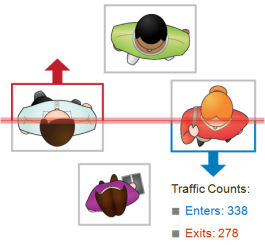

The end result was that we knew exactly how to position ourselves to differentiate away from the rest of the competition. When the customer thought about the pitches they thought about us on one side and the competition as a cluster on the other. Our value vs. theirs was implied and we didn’t have to spell it out or waste valuable time in our pitch. We knew what they were and what we didn’t want to be. We just had to believe that it was how the customer felt as well.

Don’t be a hater

That is all to say: Don’t be a hater. Don’t make it personal. Don’t be vindictive. Love the game of it all.

In the end: it is a game and if you don’t realize that you will be the first to run out of steam.

This is all especially true in enterprise software where the customers (nee users) are actually being treated like crap by your competition. A little empathy goes a long way with them.

A lot of people like to pretend they love their competition and talk a friendly game. That is fine, it is probably your best default position, but when the time comes to walk out of that corner and start landing punches then we all expect you to make them count. Your customers will respect it, your employees will respect it and more than any other: your competition will respect it.

Just make it count.

Some great news for Ontario, and the national startup community, today. We are hearing from multiple sources that John Ruffolo will be joining

Some great news for Ontario, and the national startup community, today. We are hearing from multiple sources that John Ruffolo will be joining