The news is finally public that StandoutJobs, a Montreal, Quebec company who we mentioned in our earlier post about DEMO08, has raised $2million from iNovia Capital.

With this announcement and their launch at DEMO, StandoutJobs is taking back the veil on their business model. When we first saw them almost a year ago, StandoutJobs looked like a recruiting company that did videos, and we didn’t find it very compelling. I got to hear more a few months ago however over supper with Ben Yoskovitz, and it started to make a lot more sense. StandoutJobs will be providing a SaaS solution to companies that essentially lets them build a complete hiring page that is much more rich and user-focused than the normal “email [email protected]”. The pages are fully customizable and seem to be focused on helping the company display much more current and directly useful information to the potential hires. For a more detailed overview, check out this post on Mashable.

With this announcement and their launch at DEMO, StandoutJobs is taking back the veil on their business model. When we first saw them almost a year ago, StandoutJobs looked like a recruiting company that did videos, and we didn’t find it very compelling. I got to hear more a few months ago however over supper with Ben Yoskovitz, and it started to make a lot more sense. StandoutJobs will be providing a SaaS solution to companies that essentially lets them build a complete hiring page that is much more rich and user-focused than the normal “email [email protected]”. The pages are fully customizable and seem to be focused on helping the company display much more current and directly useful information to the potential hires. For a more detailed overview, check out this post on Mashable.

iNovia Capital bills itself as a “seed and early-stage venture capital fund” with offices in Alberta (Edmonton and Calgary) as well as Montreal. They seem to be increasingly active with their investments and I am impressed that they took the entire $2million round to themselves, which likely speaks to the solid team that StandoutJobs has in place as well as iNovia’s willingness to get out there and shoulder some risk.

iNovia Capital bills itself as a “seed and early-stage venture capital fund” with offices in Alberta (Edmonton and Calgary) as well as Montreal. They seem to be increasingly active with their investments and I am impressed that they took the entire $2million round to themselves, which likely speaks to the solid team that StandoutJobs has in place as well as iNovia’s willingness to get out there and shoulder some risk.

In case you think you are being hit with a case of Deja Vu, you are right: StandoutJobs did previously announce that they had raised funding from Garage Ventures Canada, but this seems to have fallen apart. On the StandoutJobs blog:

“As well, it?s time to announce a bit of news with respect to our financing. Although we announced some time ago that we raised money with Garage Technology Ventures Canada, that did not in fact come to pass. As we got deeper into the process with Garage, it was clear that it was not the best fit for us. We wish Garage the best of luck.”

It seems that whatever came to pass with Garage did not take away from the credibility of StandoutJobs or the team there, as iNovia seems to have quickly seen the opportunity.

Congratulations to everyone at iNovia and StandoutJobs.

There are 5+1 Canadian companies on the slate at

There are 5+1 Canadian companies on the slate at

By far the most exciting space at least as far as startups are concerned is internet gaming. The flash enabled browser represents a distribution channel larger than xbox, playstation, and wii combined. There are of course challenges, internet users have grown accustomed to free.

By far the most exciting space at least as far as startups are concerned is internet gaming. The flash enabled browser represents a distribution channel larger than xbox, playstation, and wii combined. There are of course challenges, internet users have grown accustomed to free.  I wasn’t exactly sure what to think when I first took a look at

I wasn’t exactly sure what to think when I first took a look at

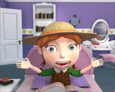

2-3 weeks later two packages will arrive: a welcome kit (which includes a fingerprint scanner and a copy of the book Anne of Green Gables) at the parents home and a password card at the sponsors home. The sponsor then must call the parents to reveal the password. And that is just the sponsorship piece.

2-3 weeks later two packages will arrive: a welcome kit (which includes a fingerprint scanner and a copy of the book Anne of Green Gables) at the parents home and a password card at the sponsors home. The sponsor then must call the parents to reveal the password. And that is just the sponsorship piece. A subscription to Anne’s Diary costs $119.99 a year. For comparisons sake, Club Penguin costs $60 a year and Webkinz $15. The games on Club Penguin are actually pretty fun and you get to play with other penguins! With Webkinz, you get a physical stuffed animal even before you register!

A subscription to Anne’s Diary costs $119.99 a year. For comparisons sake, Club Penguin costs $60 a year and Webkinz $15. The games on Club Penguin are actually pretty fun and you get to play with other penguins! With Webkinz, you get a physical stuffed animal even before you register! So what does being “the first biometrically-secured social networking site for children in the world” mean in terms of security? We’re not exactly sure… The issue is content not authentication. What’s to stop Uncle Lester from using a logged in but unattended computer?

So what does being “the first biometrically-secured social networking site for children in the world” mean in terms of security? We’re not exactly sure… The issue is content not authentication. What’s to stop Uncle Lester from using a logged in but unattended computer?