GigPark, a Toronto, Ontario startup, has finally come out of private beta and is now live.

GigPark, a Toronto, Ontario startup, has finally come out of private beta and is now live.

GigPark is a site to review and recommend local service providers amongst your friends and contacts. That means that if you hire a plumber for example, you can review his/her work and it will be shared with other people who you have friended, just like Facebook or any other number of social applications.

This is in contrast to most current review sites, which give you reviews about service providers that could be written by anyone. With GigPark you can get recommendations directly from your friends, either by viewing service providers that they have reviewed already, or by asking for a specific recommendation. Many review sites such as Amazon.com and Tripadvisor try to build the authority of the reviewer by showing you information about them (such as other reviews they have written, etc), but they remain ripe with fraudsters and hucksters and it is basically impossible to eliminate those people unless you take GigPark’s approach.

GigPark has a very tight focus and it cuts through a lot of the mess of recommending new things to friends with a clean approach that reminds me of FaceBook before they launched FB apps. GigPark has also launched a Facebook app to compliment their service. The app is much more tightly integrated with FaceBook than most apps, which is nice.

GigPark has a very tight focus and it cuts through a lot of the mess of recommending new things to friends with a clean approach that reminds me of FaceBook before they launched FB apps. GigPark has also launched a Facebook app to compliment their service. The app is much more tightly integrated with FaceBook than most apps, which is nice.

GigPark is taking a very fundamentalist approach to using the social network (or Social Graph as it now seems to be called) in their design of the service. Where it would be easy and lucrative for GigPark to find ways to publicly expose these recommendations, and it would also be profitable to resell the content, Noah and Pema assured me last week that they focus was on creating a safe and trusted space for users, and that might mean giving up some short term opportunities. That includes not selling off the reviews as “content”.

If they get a significant amount of people signed up and engaged, then this approach is going to pay off by entrenching GigPark as the most effective review site. The use of a social network gets around the significant authority and spam problems that we mentioned in our review of HomeStars. The bet is however, can they build that audience?

The hitch is that GigPark falls squarely in the YASNS category and getting people to sign up for a new site and then to have them re-create their social network is tough. The pitch is that GigPark has a very defined and obvious value, and the opportunity is huge.

GigPark is self-funded and is run by Pema Hegan and Noah Godfrey.

My profile is here, add me!

Just a reminder that next week on Tuesday February the 26th is

Just a reminder that next week on Tuesday February the 26th is  Montreal seems to be the hotbed for controversy in the Web 2.0 world in Canada. Where else could you find someone who

Montreal seems to be the hotbed for controversy in the Web 2.0 world in Canada. Where else could you find someone who  La Presse, a French-Daily in Montreal has been

La Presse, a French-Daily in Montreal has been  IOU Central

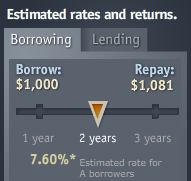

IOU Central From a borrower’s perspective, IOU Central operates much like any other lender, in that a borrower’s initial “rating” is based primarily on their credit score. You can however supplement that score by uploading a number of other documents to do things like prove your income, itemize your monthly expenditures and other things that can bump up your overall score.

From a borrower’s perspective, IOU Central operates much like any other lender, in that a borrower’s initial “rating” is based primarily on their credit score. You can however supplement that score by uploading a number of other documents to do things like prove your income, itemize your monthly expenditures and other things that can bump up your overall score. Tomorrow morning at 9am (Friday, February 8th 2008) there will be a meeting at Foreign Affairs and International Trade Canada?s Toronto offices (151 Young St, 3rd floor boardroom) to discuss their subsidy for any companies who are going to be going to

Tomorrow morning at 9am (Friday, February 8th 2008) there will be a meeting at Foreign Affairs and International Trade Canada?s Toronto offices (151 Young St, 3rd floor boardroom) to discuss their subsidy for any companies who are going to be going to  When Heri first announced

When Heri first announced  You are all DEMOgods to us! As promised here are the DEMO videos from our very own:

You are all DEMOgods to us! As promised here are the DEMO videos from our very own: