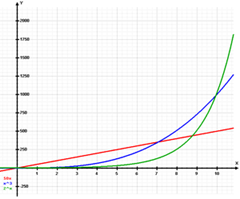

I’m always giving consultants a hard time. It’s not that I dislike consultants. It’s not that I think that consulting is a bad business model. It’s that a consulting model is very difficult to get exponential growth. You know that hockey stick growth curve, well it’s actually an S-curve but early it looks like a hockey stick, that is so important. I’m talking about real numbers, not projections. Revenue. Users. Customers. (Need help figuring out what you should be tracking? Go read Dave McClure’s AARRR! Startup Metrics for Pirates). And go read Mark MacLeod about why compound growth changing your funding requirement.

Consulting is a linear growth business. It grows based on:

- # of consultants billing

- # of billable hours

- hourly rate

Unfortunately, all of these are limiting variables. There are examples of very profitable firms and corporate structures that enable a very profitable model. I’m not discounting the profitability of the Big5 consulting firms. Consulting firms are generally limited to the number of consultants. Corporate culture are defined by the people.

The number of billable hours is a limiting factor. There are only 8760 hours in a year. You can’t work every hour. You can’t bill every working hour. It’s just not possible. Billable hours are the currency of consulting and legal firms. Many firms require 1700-2300 billable hours/year. Just think about this: 2300 hours/year = 46 billable hours/week + 2 weeks of vacation. If you assume a 80% utilization rate, i.e., 80% of your time is billable and 20% is on overhead/email/meetings/etc. To achieve 46 billable hours you need to work 57.5 hours per week.

Hourly rate is generally set by the skill set and the market. Flippa. Rentacoder. 99designs. crowdSPRING. Elance. There are others willing to do it for less.The market determines a consultants hourly rate.

So for an independent consultant billing at $200/hour on a 57.5 hour work week at 80% utilization would have revenues of $460,000/year. This is an extremely high rate. Looking at the NASDAQ 100 using Cognizant averages $35,892 versus Apple ($1,014,969), Ebay ($551,049), Microsoft ($663,956) and others. This might be a little extreme. Don’t believe me, Hoovers.com suggests that IT/software consulting has average revenues of $160,000/employee (MarketResearch.com has this closer to $100,000/employee). Realistically the easiest way for a consulting firm to achieve exponential growth is to grow to the number of consultants working. And the risk of exponentially growing the number of consultants is that you kill the culture that attracts many people in the first place.

“But isn’t the consulting company itself startup? No, not generally. A company has to be more than small and newly founded to be a startup. There are millions of small businesses in America, but only a few thousand are startups. To be a startup, a company has to be a product business, not a service business. By which I mean not that it has to make something physical, but that it has to have one thing it sells to many people, rather than doing custom work for individual clients. Custom work doesn’t scale. To be a startup you need to be the band that sells a million copies of a song, not the band that makes money by playing at individual weddings and bar mitzvahs.” – Paul Graham

That said, consulting is a great way to take the risk out of a startup. The best consulting projects are the ones where you can build the software you want to sell as a product. This assumes that you have necessary legal agreements where you retain ownership of the intellectual property created during the consulting gig. This is often referred to as “bootstrapping” (read Paul Graham’s Fundraising Survival Guide to understand the tradeoffs).

There’s nothing wrong with consulting. It’s a perfectly viable career. It’s a perfectly viable business model. But do the math, it doesn’t scale like a product company.