I hate firing people. It’s the worst part of my job. Even after all these years I still spend days or even weeks agonizing over a decision to let someone go. I feel absurd complaining about this, given that of course it’s a hundred times worse for the person being fired than it is for me. Still, I hate firing people.

My first firing at Top Hat was our VP Sales. He was employee number two, he joined right after we raised our angel round. In retrospect it was doomed from the start, and it was entirely my fault. I had no idea what I was doing when it came to building a sales organization and brought him into a role that didn’t make sense (read about the lessons learned in building a sales team). It took me 6 months before I finally pulled the trigger. In the end, it was undoubtedly the right decision and set the company back on track. But at the time it was an extremely tough call. It was admitting failure – to myself and to our investors – that this first major hire was a mistake. I felt ashamed about it for months and kept convincing and re-convincing myself that we could still make it work.

As a general rule once you’ve lost faith in an employee, things rarely get better. You can sometimes fix a skill-level problem by giving someone time to grow, but you can never fix a personality problem. If you’ve identified that someone isn’t a fit you need to move on it quickly and decisively. The longer you wait the worse it will be for both parties.

Firing is an essential part of running a successful company.

In a narrow way, it’s actually more important than hiring. You could, in theory, use a shit-against-the-wall style hiring strategy and as long as you filter out the bad apples quickly enough you’ll be able to build up a functional team over time. Of course that’s probably not the best approach.

The reality is that even the most effective interviewers are rarely more than 70% or 80% accurate. The average interviewer is quite a bit worse than that and isn’t much better than chance – often even worse, because the naive approach just selects people who are great in interviews, which disproportionately selects for bullshitters. However, even if you’re some kind of super-human talent screening machine with a 95% success rate, that 5% will accumulate and degrade the culture until you’re surrounded by bozos.

The Best Firing Process is a Better Hiring Process

Of course the best “firing process” is not to have to fire people, which can only be done through effective hiring. That being said, not having an effective firing process is like not having an immune system – the first cold will eventually kill you.

It’s fairly common knowledge these days that A players only like to work with other A players. A slightly more subtle observation is that someone’s status as an A player isn’t fixed. Bringing a weak player onto a team has a tendency to poison the culture and downgrade the rest of the team (especially if that weak player has a shitty attitude.) This bad apple syndrome has been observed to happen fairly reliably in studies on organizational dynamics.

![]()

![]() Some rights reserved by MrB-MMX

Some rights reserved by MrB-MMX

The Bad Apple Syndrome

We’ve experience this at Top Hat a couple of times. One of the most instructive was with our inside sales team. Early on when we were in a pinch to fill the team we lowered our standards and brought on a few people that we should have passed on. The results were disastrous. The quality of the team degraded and eventually hurt not only the inside team but also other parts of the company that came into contact with it. It took nearly a year of solid effort to rebuild the team. For a time it seemed hopeless. No matter what changes we put in place, no matter how much talent we threw at the team, the cancer of negativity and poor morale just wouldn’t go away. The most profound mistake we made in the process of trying to fix the team was to keep those who were performing well but had a negative attitude.

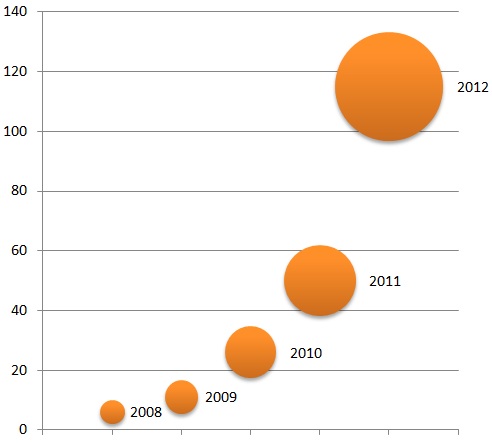

There was a pattern we observed a few times: we’d put a new person into the team, their performance would be great and they’d be super enthusiastic. Then like clockwork after a week or two their numbers would slowly drop, and they’d become engrossed in the culture of negativity and gossip. It was only after the cleared out the ringleaders who were perpetuating the negativity (who happened to have decent performance numbers!) and put in strong positive management that things finally began to change. The most amazing thing is that many of the people who were B or even C players when the team was dominated by negativity shot up to solid A player status. The overall output of the team per person went up by nearly 300%. In addition it seems as though life was trying to setup a lab experiment for us to prove just how much things had improved – we had a person who had left the company a few months prior re-join the team. His feedback was that he was blow away, he couldn’t believe it was the same team.

Lessons Learned

The first lesson we learned was that no matter how strapped for manpower you are, no matter how much it seems like the world will end if you don’t fill a position, compromising on the quality of talent will surely be more damaging. Second, we learned that in fixing a damaged team the key is to identify the cultural sources of the underlying problem and focus on those. Finally, we learned to use a divide and conquer approach – we would pull all the top talent into a separate team while rehabilitating the broken remaining team separately – it really helped prevent the “negativity cancer” from spreading while we were fixing things. These are simple things in retrospect, but it took a while to pull it off.

One of the most revealing questions I tend to ask when interviewing potential managers is whether they’ve ever had to make the decision to fire someone. The answer and subsequent discussion usually tells you two things: first, it tells you if the person has ever had to deal with the most difficult problems in management, second it tells you if they know how to handle those problems through the process they followed. Assuming the person has ever had to hire and manage a team of a decent size for any length of time, it’s almost certain they’ve made hiring mistakes, and their answer tells you that they know how to detect and correct these mistakes. If the person simply walked into a mature team, or has had HR handle all the hiring/firing decisions for them, then they’ve been living on easy street.

The process of firing someone is always somewhat unique to each situation. That being said there are some basic principles that you should always follow:

- Give people plenty of notice and regular feedback. Give people several chances to improve. The actual firing should never be a surprise – if it is then you almost certainly did something wrong in setting expectations. Depending on the role the whole process should take 1-2 months (longer for senior roles.)

- Try to be generous with severance and leave the person in a good spot to find their next employment. I know it’s not always possible in a startup, but do what you can. It’s the decent thing to do.

- Take time to reassure the rest of the team and explain (with discretion) the process that was followed and why the decision was made. Letting someone go is always a huge morale hit (even if the person wasn’t well liked, it still scares people.) You need to make people understand that their job is not in danger.

Firing someone is always a brutal experience. Anyone who says otherwise is either lying or is a psychopath. That being said, it’s unfortunately a necessary evil and understanding when and why it needs to be done is essential to the success of any business.

We have been committed to connecting high-tech entrepreneurs, companies and enthusiast. Two major vehicles for connecting the community are

We have been committed to connecting high-tech entrepreneurs, companies and enthusiast. Two major vehicles for connecting the community are