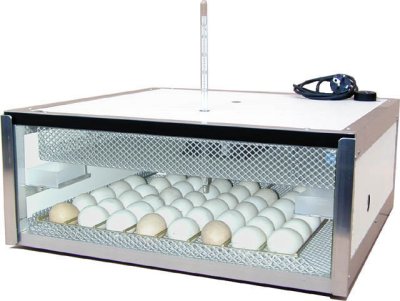

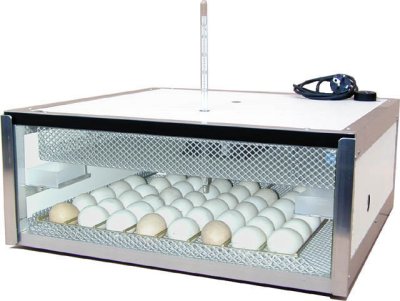

I abhor the term “incubator”. I remember in fifth grade when our teacher brought in a chicken incubator to show us how chickens are born.

I abhor the term “incubator”. I remember in fifth grade when our teacher brought in a chicken incubator to show us how chickens are born.

We waited and waited and waited a while longer still.

All the little Chickens were dead, it turned out. We weren’t quite sure why but most of us thought that one of the guys in our class with “anger issues” was somehow responsible.

So to this day when I hear the term incubator, I think of a sea of dead chickens and the broken dreams of little boys and girls.

So I was surprised when I walked in to Year One Labs today and, rather than chickens, I saw a lot of people. Not just any people either, but some of the best entrepreneurs I have met in years.

We wrote about the launch of Year One Labs back in September 2010

The current portfolio of Montreal based Year One Labs includes:

High Score House

HighScoreHouse was founded by Kyle Seaman and Theo Ephraim. The company is building a fun, entertaining solution to help parents use positive reinforcement to motivate their children.

They have yet to launch but you can learn more at highscorehouse.com.

Localmind

Localmind was founded by Lenny Rachitsky and Beau Haugh. Localmind allows people (from the web or their mobile phone) to ask questions of people checked in at locations. Questions can be in real-time or not. The big vision is to empower people to know anything they need to know about any place at any time.

Localmind is currently available online at localmind.com.

Please Stay Calm

Please Stay Calm was founded by Garry Seto andKen Seto. The company is building a massively co-operative location based social game with a zombie theme. They have not yet released the game, but you can sign up for news at pleasestaycalm.com.

And you can learn more about the game and their progress on their blog.

as well as Assemblio and one other as of yet unnamed startup.

There are some things to love about Year One Labs:

- The founders of Year One Labs have their own money invested

- The founders of Year One Labs are experienced founders with good operational backgrounds. It seems clear to me that they know how to gradually disengage as the founders of resident companies get their feet under them. They aren’t constrained by awkward incubator contracts or “client service agreements” where a lot of resources go more and more unused as a startup outgrows them. That flexibility is important.

- They have a bar built right in to the lobby

It’s not all ice cream and pie for these guys though, from the outside it is clear to me that follow-on financing relationships are always going to be tough for groups like this and keeping the lights on does become a heavy expense over time.

This sort of activity, much like Extreme Venture Partners in Toronto and the work that BootupLabs had been doing in Vancouver is the lifeblood of an early stage startup community. Whenever politicians give speeches and talk about things like the “IT Sector” and “knowledge workers” — this is what they are talking about. We have to find careful ways to support efforts like Year One Labs but also keep the market competitive enough that the best ones may rise to the top. In the current model of massive infusions of cash for real-estate and bureaucrats does not let the market pick the winners.

The entrepreneurs are the ultimate customers here and they will be the ones who make or break Year One Labs and every other similar effort in Canada.

Our friends Philippe Telio (@ptelio), JS Cournoyer (@jscournoyer) and Alistair Croll (@acroll) have pulled together a spectacular festival in Montreal for startups. They launced today at AccelerateMTL and the speaker list includes great folks:

Our friends Philippe Telio (@ptelio), JS Cournoyer (@jscournoyer) and Alistair Croll (@acroll) have pulled together a spectacular festival in Montreal for startups. They launced today at AccelerateMTL and the speaker list includes great folks: