Note: This is a guest post by Jesse Rodgers who is a cofounder of TribeHR. Jesse specializes in product design, web application development and emerging web technologies in higher education. He has been a key member of the Waterloo startup community hosting StartupCampWaterloo and other events to bring together and engage local entrepreneurs. Follow him on Twitter @jrodgers or WhoYouCallingAJesse.com.

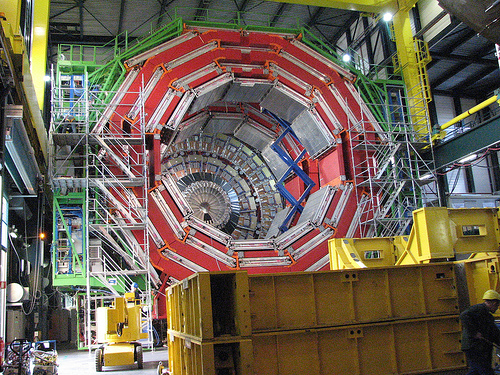

Incubators and accelerators [Eds note: and cyclotrons] have but one purpose: move startups along in their life cycle at a faster pace than they would normally and increase the likelihood of a return by providing that service. If you are a startup looking at applying to an incubator you need to understand that the differences in how these programs differ go beyond the money they give you in exchange for equity.

An oversimplification of the incubator/accelerator space is to classify them as either a Y-Combinator (YC) or a TechStars (TS). If you really look at the booming world of incubators for high tech startups you see a model that either based on education and peers that is driven by a strong personality (YC) or a model that is more institutional, follows a script, and feels less personal but is more in line with how VC’s work (TS) (I would place 500 Startups right in the middle between YC & TS which is arguably representative of a third type). There is plenty to be found about the differences but here is a bit of a deeper exploration into the differences.

Startup lifecycle

Startups have a number of key phases in development that is best outlined in Fred Destin’s presentation on startup lifecycle.

- Start

- Launch

- Build

- Chasm

- Scale

With the 12-14 week cohort models, like YCombinator and TechStars, the focus should be on moving through starting and on to launch phase. There may be some that get into a build phase. The incubator or accelerator hopes that once they are done a 12-14 week program the startup will be in a much better position to move quickly through the build stage and at least take on the chasm phase.

Where I see the key difference between YC and TS is that YC seems to be able to get companies to go through stage 1 to 3 and they accept companies mainly in the start phase. TS seems to not attract a cluster of companies in a particular phase or not care about what phase a company is in.

The basics of an incubator/accelerator (whatever you want to call it)

Within the execution of any incubator or accelerator program there are, in my mind, 4 core stages in a typical cycle:

- Recruitment

- Onboarding

- In the program

- After the program

Within each of these of these stages there are a number of specific activities that all incubators do but in general they aren’t all that different.

Recruitment

YC currently leads the thought leadership with Hacker News, Paul Graham’s (PG) blog, and it’s success. Applicants fill out a form and once told they have an interview, travel to YC in Mountain View for an interview. They get just 15 min with a small panel and the panel does a bunch of tricks to the founders like carrying on side conversations – there are a lot of blog posts about that.

TechStars has adopted a more consistent process over it’s many affiliated programs (it appears) but they lack YC’s Hacker News or thought leadership (although they would claim otherwise). With Techstars there appears to be an affiliation with the Kauffman Foundation and the role they are taking in promoting the incubator model in general they have made themselves an authority in the space. From people I know that have been in the program it is a fairly standard process similar to raising Angel capital.

Onboarding

I am not sure on TS on-boarding but YC has a very short interview to decision to start of program window. YC has a little book that is like a long Wikipedia article written by Paul Graham that offers insights and baseline knowledge. From what I have been told the YC machine is pretty much immediately available to you when they say “you are in” — startups decide when to tell others. What is really interesting is that YC doesn’t announce it. They generally let a company know they are YC funded on the interview day but they don’t make a big announcement or anything.

Not having a big incubator announcement is a key difference here though. I will assume that with TS it is just like YC in that they have decided to fund you, they are now available to you. However, TechStars (it appears) doesn’t approach announcing the cohort in the same way as YC — they announce them ahead of the program.

In the program: peer mentorship, startup culture

Each program runs for roughly 3 months, 12-14 weeks, where mentorship, various events, and a demo day to close it off normally occur. Each week is important given that each team only has 3 months. Over three months there are phases you can generally identify:

- Teams becoming familiar with each other, their mentors, and what they need to do (first 2 weeks).

- The heads down getting stuff done phase (8-10 weeks).

- Funding mode going into Demo Day (2 weeks).

Other incubator programs are fairly similar with any given week involving office hours (optional or required) and a speaker/dinner. The office hours are used to check in and place goals on the teams. Throughout the term there are demo nights, which are used by YC as a way to put peer pressure on other teams that might not be moving as fast as others.

Where they differ here is in the education of the founder(s). From everyone I have talked to that has gone through YC it seems to me it is a very challenging but rewarding relationship for a certain type of founder. That would make sense as a certain personality type will work best with Paul Graham’s way of doing things and will excel. I am not entirely sure it is simply a hacker/coder persona as most assume. I think it is a personality and learning style that goes a bit deeper.

TechStars has a co-working model with parts very similar to YC. The key difference is that TS doesn’t have the Paul Graham approach to educating founders so you will get very different details depending on who is running the program. TS also gives the startups a place to work where YC leaves them to find a house and work out of it.

After the program: Alumni network

The key value any incubator or accelerator provides after the program is the alumni network of companies that are now a few steps ahead (depending on the age of the incubator there could be alumni with very large companies) of the current cohort in the program. Over time these alumni are your best mentors and connectors.

It is at this phase where the greatest value is for the startup, I believe. You now have access to what the old folks call a big rolodex (social graph) that will open many doors which essentially leaves it up to the entrepreneur whether their company will succeed or not. There are few to no barriers, generally speaking.

Any alumni of YC or Techstars still have contact with the folks in their cohort and all cohorts along with Hacker News. Techstars Network is so big they have a conference just for alumni while YC taps its alumni for all kinds of things. Also, founders seems to find going through the program a second time is different but just as valuable. These massive networks of successful alumni with a flock of high profile admirers is very similar to that of Higher Education alumni networks, so much so it convinces me that this entire process is a form of higher education.

Programs that work copy YCombinator, even TechStars did

![]()

![]() Some rights reserved by andi.vs.zf

Some rights reserved by andi.vs.zf

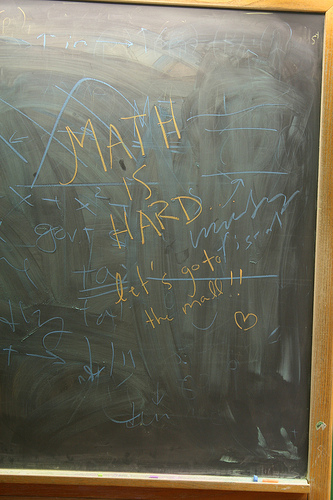

The current culture of education focused incubators started in my mind with YCombinator (started in 2005). I believe what we are seeing with the success of YC and TS is new take on graduate school. Both are different, both work, and people can have strong opinions either way. They feed a need that I don’t think people outside of incubators quite understand yet, learning to be a founder is really hard. Being a successful founder is even harder. The bet is that if you help young founders focus on what is important they will see success earlier or just simply see what success looks like.

If you are looking at an incubator anywhere (there are lots of great programs out there) you need to understand that the money is secondary. You need to find a program that will fit with the way you learn and has companies that you want to work with. It is just like how you picked your University or College except this time it can cost you a lot more (in equity) if you are successful.

Note: This is a guest post by Jesse Rodgers who is a cofounder of TribeHR. Jesse specializes in product design, web application development and emerging web technologies in higher education. He has been a key member of the Waterloo startup community hosting StartupCampWaterloo and other events to bring together and engage local entrepreneurs. Follow him on Twitter @jrodgers or WhoYouCallingAJesse.com.