Editor’s Note: Daniel Klass (LinkedIn, @klasscapital) is an experienced private equity investor having spent time at TD Capital and EdgeStone Capital Partners before raising his fund Klass Capital. Daniel and the team at Klass Capital focus on small to mid sized web-enabled businesses seeking to invest $500,000 to $5,000,000 of growth capital. While none of the entrepreneurs or CEOs are named in Daniel’s post, you can be assured some of these stories are direct lessons from portfolio companies like Firmex and Nulogy. You can follow Daniel on twitter @klasscapital and read his additional early-stage tips for entrepreneurs.

![]()

![]()

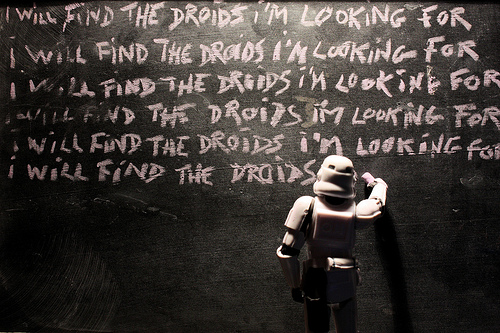

![]() Some rights reserved by Stéfan

Some rights reserved by Stéfan

Klass Capital’s 11 Lessons for Early Stage CEOs

- Don’t overbuild your product or build your product in a vacuum.

We learned one of our best lessons from a CEO that told us that he was going to “sell the shit” out of his product and build a great product later. Five years later, the business does in excess of $30mm SaaS revenues. The best products are built with customers and not for customers. - Understand your cost of customer acquisition.

We often gravitate towards build an external sales team, spending money on expensive tradeshows and not understanding the cost and pay back of these initiatives. Our best in class online businesses all started out that way and have moved to an online and inside sales and marketing engine. The metric we live by is a ratio of life-time value of a customer to cost of acquiring the customer of no less than 3:1. - Religiously measure your churn by cohort.

Early stage CEOs are fixated on sales and do not fully understand monthly churn. Service, support and innovate. You will learn a lot from your customers and lowering churn will significantly reduce CAC. To truly understand your churn and see if you are making progress, start measuring churn by cohort. Once your company matures, churn should not exceed 10% and upselling existing customers should significantly eat into this churn. - Too many CEOs rely on the success of channel partners.

We rarely see channel partners work and at least from our perspective the risk and time commitment invested in these partnerships rarely makes sense. - Raise more money than you need.

The fund raising markets are not always open and raising capital is a distraction. Choose the right partner, the right structure and raise 1.5x-2x the capital you need. Build a strong advisory board that can help guide you through this process and use the board to lever off their relationships. - Learn from your competitors, learn from your customers and don’t be defensive.

Almost every portfolio Company we have has significantly evolved and only slightly resembles its initial existence. - Define and redefine roles when looking for people.

Hire managers who are player-coaches and not scared to roll up their sleeves. - Build a financial plan that you can measure yourself against on a monthly basis.

Record and measure your key metrics monthly. Constantly refine these metrics and keep your feet to the fire. For all our businesses we use monthly, if not weekly, flash reports. We measure everything from churn, usage, MRR, new customers, renewals, average revenue by customer, etc. Share these metrics with your advisors and make yourself accountable. - Make sure that all your heated discussions with team members, board members, and advisors are constructive.

Do not be defensive and take your time to respond. These discussions, even if you are correct, almost always result in a better outcome. - Choose your target markets carefully.

It’s easier to have customers with deep pockets and large markets. This will significantly increase your exit value. - Build businesses where you can take advantage of the network effect. Lots of good things happen with scale. Best in class businesses find you to launch their products, data mining opportunities become available, and you gain domain expertise.

Editor’s Note: Daniel Klass (LinkedIn, @klasscapital) is an experienced private equity investor having spent time at TD Capital and EdgeStone Capital Partners before raising his fund Klass Capital. Daniel and the team at Klass Capital focus on small to mid sized web-enabled businesses seeking to invest $500,000 to $5,000,000 of growth capital. While none of the entrepreneurs or CEOs are named in Daniel’s post, you can be assured some of these stories are direct lessons from portfolio companies like Firmex and Nulogy. You can follow Daniel on twitter @klasscapital and read his additional early-stage tips for entrepreneurs.

Leave a Reply