On Sunday, Jevon announced that Brightpark, one of Canada?s most famous technology VC?s, has begun doing contract web work.

This is the second VC-incubator in Canada, in the last year, that has moved to doing contract web development. Not long ago, STN Labs (located in my company?s hometown of Guelph) made a similar move. STN Labs once touted itself as being a solution to the ?VC Problem in Canada? ? they were hybrid VC 2.0 / Angels that came in early and had real operational experience. Well it didn?t work: STN unofficially stopped investing and is now primarily doing contract web-work.

Jevon mentioned Ventures West and Celtic House in his blog post ? hinting at how Brightspark?s announcement fits into the bigger picture of VCs in Canada.

There are big differences between Brightspark and STN versus Ventures West and Celtic house. The latter two were both traditional, large scale VC?s, while Brightspark and STN were both recently propped up for getting in at early stages, being hands-on, and also doing incubating.

Over the last two years, I?ve heard many fellow entrepreneurs talk about how the the old style of VC investing is dead. Conversationally, the Brightspark and STN models were, last year, seen as the solution for the problem.

Turns out that neither was right. All VCs, big, small, traditional, or innovative: all are having trouble.

Focusing again on the bigger picture, it?s interesting to look at what is similar between all four VC?s mentioned here and to look at the VC?s in Canada that are still actively investing and think about what?s special about them.

I?ve met Mark and Tony from Brightspark and consider them friends ? I know them both as brilliant people, the kind of guys with whom entrepreneurs would be honoured to work. I don?t see this as a sad move for Brightspark, both Tony and Mark are walking success stories who get to work on projects that are driven by passion. They?re still doing that.

In the general sense, it?s pretty simple to see what?s going on in the big picture (even ignoring this recent announcement from Brighspark):

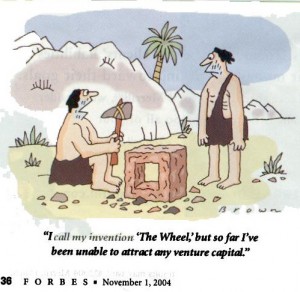

We don?t have a surplus of interesting businesses with numbers that will make VC?s happy.

At the same time, Canadian VCs talk about how they invest with the hopes that only 1 out of 10 businesses that they fund will be slam dunks, while at the same time they are too risk averse to invest in businesses that have only 1 in 10 chances of succeeding. No business can filter through this impossible sieve: returns of the size demanded by large VCs require small startups with high risk. Many of the VCs I meet in Canada think that they can get around this impossible sieve problem by being smarter investors: every VC I know says that they will not have 1 in 10 success rates ? rather, they aim for success 4 or 6 times better than this rule of thumb. Looking at their past history, however, they all admit to success rates much worse than the same rule of thumb.

Of course this has a cyclical effect. With funding scarce, working as an employee at startups in Canada, pretty much across the board, is not a great way to get a high salary. And although salary is only part of what makes a job great, it is ? realistically ? an important part. So we get a brain drain. And as funding is more scarce, and success stories even more scarce, less technology grads are willing to take big risks and pitch big adventures to investors. It?s just too scary. Less funding means entrepreneurs are being more careful, taking smaller risks, and growing more slowly. Startups now build leaner teams, hire less experienced executive teams, and release products every two years instead of twice a year.

All these facts lower the possibility of grand slams.

American VCs aren?t doing something to make themselves magically better ? it seems to me that it?s just that many of them control much larger sums of money, and from a distance it?s easiest to see what only the most successful ones are doing. Larger pools of money allow the larger VCs to keep their eyes out farther in the future, holding out while this sub-economy recovers.

Advice to Canadian entrepreneurs: look towards the growth of Angel groups, raise as much money as you can to weather the storm, tighten your vision, look towards less standard Web 2.0 business models, and be patient.

Advice to Canadian VCs: don?t worry I am not presumptuous enough to think I have any idea on how to advise Canadian VCs.