In the middle of the Facebook App frenzy (was that a whole 4 months ago?!) I wrote “Delusions of Facebook” to try to dissuade as many startups as possible from going down that path. I hate to say it, but man — I was right.

The fact is, Facebook Applications simply have not become great businesses. The few who have made any revenue are also taking almost all of the available revenue, and it is the startups who focused on things like cross-application advertising that made the most.

Facebook Applications are an unmitigated disaster from any perspective

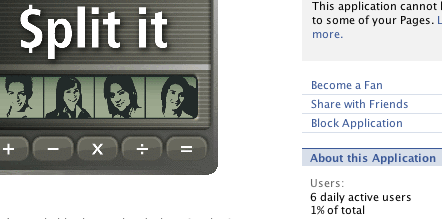

The most glaring example of this comes straight out of Toronto, the TD Canada Trust “Split the bill” application, which I have to admit seemed like a decent idea to me when I first heard about it. I mean, it seems like the perfect app for the Facebook demographic right? Apparently not. The application, which sports 6 Daily Active Users is a failure. If this were Uncov, I would be saying much meaner things.

The most glaring example of this comes straight out of Toronto, the TD Canada Trust “Split the bill” application, which I have to admit seemed like a decent idea to me when I first heard about it. I mean, it seems like the perfect app for the Facebook demographic right? Apparently not. The application, which sports 6 Daily Active Users is a failure. If this were Uncov, I would be saying much meaner things.

“$plit It” is, in case you are wondering, beaten squarly by the the “Which millionaire should you sleep with?” application, which has 32 times the number of users and presumably has significantly less grand goals. There are examples of underperforming Facebook applications everywhere however, it isn’t just TD Bank that has struggled with the concept.

The last stand, unstood(tm)

One argument could be that Facebook Applications might attract fewer active users than a valuable Web Application, but they are more valuable users because Facebook let’s you leverage the “Social Graph” and the network effects of Facebook exposure. While I thought I debunked that idea in my last post, I still hear the argument sometimes.

Sadly, the numbers don’t seem to add up there either. The best example out there is the Causes Application.

| Cause |

Users |

Donations |

| Cancer Research |

3,005,750 |

$58,520 |

| Stop Global Warming |

1,681,907 |

$20,908 |

| Animal Rights |

1,232,162 |

$19,423 |

| Against Child Abuse |

927,120 |

$7,685 |

| Save Darfur |

800,674 |

$12,528 |

Read/Write Web recently broke down the numbers for the top-5 Causes applications (Causes lets anyone create and application to support a particular charity). As you can see, even with over 3million users (more than you will ever get signing up for your application by the way), the Causes application still only managed to raise $58,520. If I remember correctly, my elementary school was regularly raising similar amounts of money by selling things like chocolate bars and pens.

Junk Food for your Business Plan

Building Facebook Applications is not a business plan, unless you are a web developer who does freelance Facebook application development (now, there is a place you can make money on Facebook Applications). It is the McDonalds equivalent of a business plan. Quick, cheap, greasy and ultimately unfulfilling.

I am glad that the hype is dying down, but even as FacebookCamp Toronto continues to draw a crowd of easily over 400 (and was a lot of fun, I admit), I worry that there are some bright startup-ready developers out there who still have Delusions of Facebook. Snap out of it, and get on with business.

Moving On

It is time for you to take your bright ideas and to put your energy in to things that can give you a return on your investment. I think even Omar saw the light, as he and his team never did venture in to the Facebook Application line of business.

The web is the most powerful platform we have, and just because someone comes along and says “hey, we made it as easy as a Big Mac” doesn’t mean you need to give them all the upside. Focus on the value you are creating, find a market that wants your product and then start building.

Eat your vegetables, you will be rewarded greatly.

Well, that didn’t take long. IOUCentral appears to have been essentially shut down by regulators here in Canada and they have disabled their loan and application functionality and are now repaying any fulfilled loans. The startup, which we covered, launched just a few weeks ago.

Well, that didn’t take long. IOUCentral appears to have been essentially shut down by regulators here in Canada and they have disabled their loan and application functionality and are now repaying any fulfilled loans. The startup, which we covered, launched just a few weeks ago. The most glaring example of this comes straight out of Toronto, the TD Canada Trust “Split the bill” application, which I have to admit seemed like a decent idea to me when I first heard about it. I mean, it seems like the perfect app for the Facebook demographic right? Apparently not. The application, which sports 6 Daily Active Users is a failure. If this were

The most glaring example of this comes straight out of Toronto, the TD Canada Trust “Split the bill” application, which I have to admit seemed like a decent idea to me when I first heard about it. I mean, it seems like the perfect app for the Facebook demographic right? Apparently not. The application, which sports 6 Daily Active Users is a failure. If this were

A lot of startups seem to be building their web apps in Ruby On Rails and have been for a while, so I thought it was worth mentioning that Toronto is home to the least-boring Rails conference so far.

A lot of startups seem to be building their web apps in Ruby On Rails and have been for a while, so I thought it was worth mentioning that Toronto is home to the least-boring Rails conference so far.

Just a reminder that next week on Tuesday February the 26th is

Just a reminder that next week on Tuesday February the 26th is  Montreal seems to be the hotbed for controversy in the Web 2.0 world in Canada. Where else could you find someone who

Montreal seems to be the hotbed for controversy in the Web 2.0 world in Canada. Where else could you find someone who  La Presse, a French-Daily in Montreal has been

La Presse, a French-Daily in Montreal has been  IOU Central

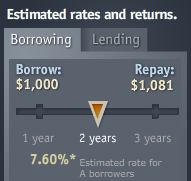

IOU Central From a borrower’s perspective, IOU Central operates much like any other lender, in that a borrower’s initial “rating” is based primarily on their credit score. You can however supplement that score by uploading a number of other documents to do things like prove your income, itemize your monthly expenditures and other things that can bump up your overall score.

From a borrower’s perspective, IOU Central operates much like any other lender, in that a borrower’s initial “rating” is based primarily on their credit score. You can however supplement that score by uploading a number of other documents to do things like prove your income, itemize your monthly expenditures and other things that can bump up your overall score.