The following is a guest post from Mark McQueen, originally written on Wellington Financial’s blog.

Thanks to the fine folks here at StartupNorth, there has been a vibrant online discussion over several days regarding the “problems” with the Ontario government’s MaRS program. As of this morning, there have been over 300 contributions from a variety of players in the ecosystem, all prompted by the observations of Dan Debow, a highly successful local entrepreneur (Workbrain and Rypple).

Before we get to the painful stuff, it must be said that there are many dedicated people within the MaRS organization and on the MaRS Board (such as Lawrence Bloomberg, Dr. John Evans and Richard Ivey) who are sincerely trying to help make the world a better place. The fact that some talented and hard-working former VCs have joined the staff in recent years speaks to the maturation of the organization and the shrinking number of real VC jobs available in Canada; but I have always believed that MaRS’ provincial benefactors (starting with former Premier Dalton McGuinty) saw the operation as a very helpful monument to their interest in innovation, first and foremost (see representative prior post “Brutal venture capital stats for H1 2007 part 3” Sept. 12-07).

The kinds of complaints you hear about MaRS are largely the same, and generally foreign to the buzz around Waterloo’s Communitech. That shouldn’t be the case.

14 years ago, I would trek down to Waterloo every few months and visit with the team there, back when it occupied a small space beside a Sunoco station. This was long before the Tannery project came together, and people like Paul Weber, Jane Jantzi, Greg Barratt and Judy Geraghty worked cheek by jowl in a couple thousand square feet. At its roots, Communitech was about helping entrepreneurs develop their business plans, find a customer, meet some mentors, and hopefully raise some Angel funding before charging off into the wild blue yonder. That’s why its early Board and network of supporters was made up of people like John Whitney, Tom Beynon, Jim Balsillie and Michael Stork. Folks who were integral to the K-W start-up ecosystem in some way or another.

Even today, the Communitech Board is dominated by entrepreneurs and connectors, such as Desire2Learn’s John Baker, Ali Asaria (CEO, Tulip Retail), Dave Caputo (CEO, Sandvine), Joseph Fung (Co-founder and CEO of TribeHR) and Carol Leaman (CEO, Axonify), among others. There are no spots reserved for Big Pharma or Mega Bank. Not that Canadian bank CEOs are not by definition successful in business; it’s just that the personal network they bring to the table aren’t the local innovation entrepreneurs. Which means you as a Board member have no ability to personally gauge whether or not your “incubator” is effectively serving its denizens or would-be clients. I’m sure the governance is second to none, but…

That’s a minor example of why Communitech has always worked in my view, and MaRS doesn’t — at least not based upon the financial resources deployed in each case. In 2012, I gave a speech to the Canadian Business Magazine Leadership Forum, and practically begged our governments to create a Communitech-like incubator in Toronto. I suppose that reflected my resignation that while MaRS was many things, it wasn’t succeeding — ten years later — at what the innovation ecosystem sees as its core mandate. Rather than try and turn the oiltanker around, you do what innovators do: start with a clean sheet of paper.

That’s why Salesforce.com exists — because someone saw what SAP couldn’t do.

Which brings us back to the StartUpNorth chat on Facebook. The first comment that caught my eye was from an entrepreneur named Bob Seeman from Clera Inc. This is what he had to say:

Our company was a tenant of MaRS, and the facilities were terrible by basic lab standards and hilariously overpriced. We are globally regarded as world authorities on a rarefied part of neuroscience that my father discovered and for which he was nominated for the Nobel prize. Despite this, MaRS proclaims to have the ability to offer taxpayer-funded advice from bureaucrats to companies like ours. That is comical. Even 99.9+% of neuro-pharmacologists around the world will admit to not understanding my father’s groundbreaking work in dopamine receptors and its effects on the brain. The idea that bureaucrats can offer us advice is absurd.

There are two sad realities here. First, that even the Ontario government can’t find marshal the talent to support ground-breaking work in science. Second, that even if you do chin up to the Bay Street real estate lease rates that MaRS demands, the labs are substandard. Perhaps Mr. Seeman’s situation would have been too much of a specialized challenge for even Communitech to have be useful to, but let’s hear from Charles Plant, a former CFO of MaRS:

I have spent over thirty years in the tech startup community including 4 years working at MaRS, ending as CFO in 2010, 2011. I have a great deal of respect for the people who work at MaRS as they are trying to do what they think is right and I have hesitated to speak out as I don’t want to offend many friends who are still there. These comments though are things I said when I was at MaRS and have continued to say since.

As with all organizations, MaRS does some things well and could improve how they do other things. The problem with MaRS is in its design. There is no customer feedback loop.

Companies get feedback through revenue from customers who do or don’t buy their products. MaRS gets funding from the government to give services away for free so customers don’t give feedback in terms of payment. Real estate development companies get feedback from lessors and from lenders who deny funding unless customers agree to lease. MaRs though, gets tenants and funding through the government so once again there is no feedback loop.

The problem with MaRS is exacerbated by the fact that there are absolutely no tech entrepreneurs on its board of directors and very few if any in senior management. Thus its leaders are not deeply connected into the tech community and they can’t get direct feedback that way.

Communitech is successful because it has a membership of tech companies, a board populated with tech entrepreneurs, and a senior management team with tech startup experience. While it gets lots of funding from the government it gets its feedback from members and thus know what needs it must meet in order to keep them as members.

MaRS needs a better feedback loop with its customers than a few surveys every year and a few blogs like this. It needs tech entrepreneurs on the board, on the senior management team and a membership that can give it feedback where the current feedback loop is missing. Maybe through a membership it could address the transparency and performance concerns that many in the community have expressed in this blog and elsewhere.

That says it all, and confirms what many have been saying for years. Good people, wrong model.

Let’s sell the fancy real estate and start over.

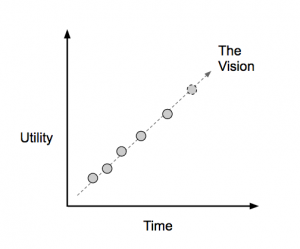

In a world of fast iteration and Running Lean, it’s easy to think of products as the entire picture. It’s one big giant dot that we hope brings us success and a mass of users.

In a world of fast iteration and Running Lean, it’s easy to think of products as the entire picture. It’s one big giant dot that we hope brings us success and a mass of users.